Advertisement|Remove ads.

BTIG Calls AppLovin A ‘Top Pick’ As Gaming Dominance Grows: Retail Says Traders Are Underestimating The Stock

AppLovin Corp. (APP) stock drew attention on Wednesday as BTIG raised its price target, citing continued optimism and noting that the company has either retained or expanded its leading position in gaming during the quarter.

The firm raised the price target to $483 from $480, while reiterating a ‘Buy’ rating ahead of the company’s second-quarter (Q2) earnings release on August 6.

Following the analyst report, AppLovin stock rose by over 2% on Wednesday afternoon.

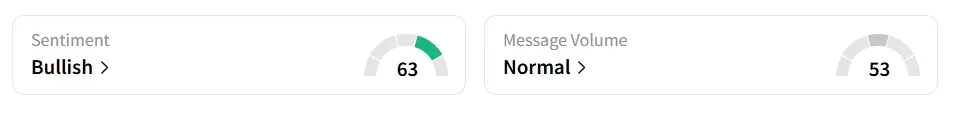

On Stocktwits, retail sentiment around the stock remained in ‘bullish’ territory amid ‘normal’ message volume levels. AppLovin saw a 27% increase in user message count in the last 24 hours.

A bullish user said retail traders and institutions are underestimating AppLovin’s potential.

BTIG stated that the firm’s gaming outperformance occurred within a broadly improving sector backdrop and designated AppLovin a Top Pick.

With gaming demand on the rise, AppLovin appears to have capitalized on the demand more effectively than its competitors. BTIG’s assessment suggested the company leveraged favorable industry trends and gained market share as it heads into earnings.

Out of the 25 analysts covering AppLovin stock, 20 have a ‘Buy’ or ‘Strong Buy’ rating, according to Koyfin data. Five rate the stock as a ‘Hold,’ while one rates it as a ‘Sell.’ The consensus price target for the stock is $463.20.

AppLovin has been a target of multiple short sellers. According to a Bloomberg report, Muddy Waters claimed that AppLovin builds its ad-targeting capabilities by gathering unique user identifiers from partner platforms, allegedly without obtaining the necessary permissions.

The reports also accused AppLovin of using deceptive tactics to boost its ad engagement and app installation metrics, thereby inflating install counts and overstating its earnings.

AppLovin stock has gained over 10% in 2025 and over 300% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_2026_2_jpg_a7bbca2bde.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2158238458_jpg_48ab7af27c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_market_OG_2_jpg_d58f0a637e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_supermicro_resized_jpg_95d12828d5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ray_dalio_resized_jpg_d2f1d535bc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_pharma_stock_jpg_490939e580.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)