Advertisement|Remove ads.

Bullish Signals: SEBI RAs See Breakout Potential In These Three Small-Cap Stocks

SEBI-registered analysts are bullish on select small-cap names as technical charts flash strong reversal signals. HBL Engineering and Indian Hume Pipe have both formed an inverse head-and-shoulders pattern, often seen as a bullish indicator, while CreditAccess Grameen is approaching a critical breakout zone.

Let’s take a look at the analyst recommendations:

HBL Engineering

HBL shares have rallied 7% in the last one week. SEBI-registered analyst Palak Jain noted that HBL Engineering is trading below the identified breakout level of ₹638. The charts indicate that it has formed an inverse head and shoulders pattern, a potential indicator of a trend reversal from bearish to bullish. This is also supported by a surge in volumes, indicating possible upside gains.

Jain set immediate targets at ₹657, ₹676, and ₹701, with a stop loss at ₹570 to limit potential losses.

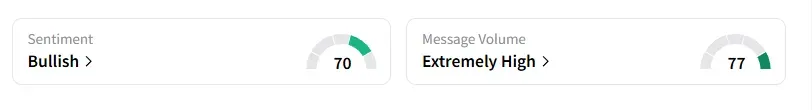

Data on Stocktwits shows that retail sentiment is ‘bullish’ on this counter amid 'extremely high' message volumes.

Indian Hume Pipe Company

Jain also flagged a buying opportunity in Indian Hume Pipe, which has rallied 10% in the last month.

Technical charts indicate that the Indian Hume stock has formed an inverse head and shoulders pattern, suggesting a potential bullish reversal. It is accompanied by strong volumes, which indicate increased buying interest and confirm breakout potential.

Jain also noted that the stock has formed a bullish trend line with higher highs and higher lows, indicating an upward trend. She sees strong support at ₹420 level, with a breakout above ₹470 leading to gains.

She suggested buying the stock for a target price of ₹510-₹525, with a stop loss at ₹420, to manage risk.

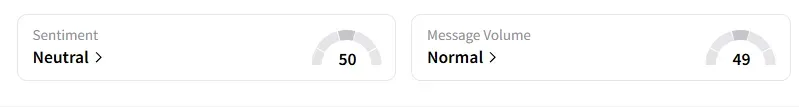

Data on Stocktwits shows that retail sentiment is ‘neutral’ on this counter.

Credit Access Grameen

Credit Access shares have rallied 13% in the last one month. Analyst Sunil Kotak sees a strong supply zone between ₹1,330 and ₹1,360. He added that the stock is likely to break out above ₹1,360. On the downside, he pegged support around ₹1,260-₹1,290.

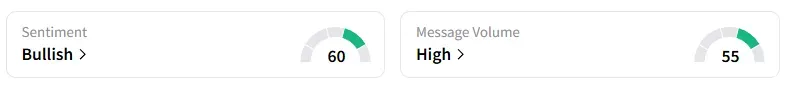

Data on Stocktwits shows that retail sentiment is ‘bullish’ on this counter amid ‘high’ message volumes.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2218096416_jpg_9d469a2ec6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229019640_jpg_c6006d7238.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)