Advertisement|Remove ads.

Buy The Dip? TCS Near Key Support Zone, SEBI RA Deepak Pal Sees Near-Term Target At ₹3,600

Tata Consultancy Services (TCS) remains a steady performer, supported by consistent growth, healthy margins, and strong deal wins.

According to SEBI-registered analyst Deepak Pal, TCS reported consolidated revenue of ₹2.4 lakh crore for FY24, with 6.8% year-on-year growth in constant currency.

TCS posted a net profit of ₹46,070 crore and held its operating margin at 24.6%.

With $42.7 billion in deal wins and a workforce of over 6 lakh, Pal said the company remains well-positioned for sustained growth, despite near-term macro pressures in banking, financial services, and insurance (BFSI) and Europe.

On the technical front, Pal observed a double-bottom formation on the daily chart, with bullish signals from relative strength index (RSI) and moving average convergence divergence (MACD).

Pal sees ₹3,415–₹3,420 as a potential accumulation range, with a stop-loss at ₹3,350. He added that a move above ₹3,500 could open the door to ₹3,600 in the near term.

Last week, TCS informed exchanges that its board will meet on July 10 to approve Q1 FY26 results and consider an interim dividend, with July 16 set as the record date.

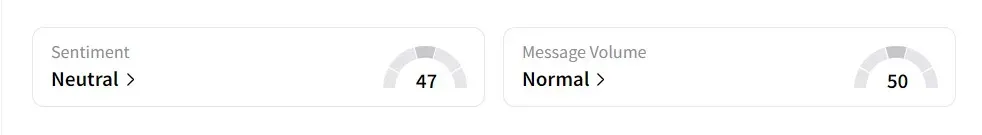

On Stocktwits, retail sentiment was ‘neutral’ amid ‘normal’ message volume.

The stock has declined 16.8% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229072591_jpg_18a80f859a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227931369_jpg_250f28d52d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2253201649_jpg_ff6c9e331b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232102203_jpg_175efe6ca4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_wall_street_resized1_jpg_7f200ce842.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2257784104_jpg_4f7b38e8a2.webp)