Advertisement|Remove ads.

BYD Eyes Higher Sales Target Of 4M Vehicles This Year, Say Morgan Stanley Analysts

Morgan Stanley has reportedly stated in a note that Chinese EV-manufacturer BYD (BYDDF) is planning to sell four million vehicles this year, which is a 11% upward revision to the firm’s previous target.

According to a Reuters report, Morgan Stanley analysts cited comments from BYD executives at a roadshow event to state that BYD attributed the additional sales growth to the introduction of new models this year with its latest plug-in hybrid technology named DM-i 5.0. This is expected to contribute a better margin, they added.

The report further noted that the order backlog of models including Qin L and Seal 06 DM-i, both priced from RMB 99,800 ($14,019), has surpassed the firm’s production capacity. However, BYD has not shown any indication of potential price hikes this year, it said.

BYD’s production of plug-in hybrid electric vehicles has risen 45.68% year-over-year (YoY) to over 1.3 million units on a year-to-date basis till August 2024. Sales rose 48.30% YoY to 1.31 million units in August. Total sales rose 30% YoY to 2.33 million units on a YTD basis till August.

The firm reportedly had its best ever month in August in terms of sales at 373,083 vehicles.

The stock appears to be increasingly gaining retail attention with message volumes rising 300% in the last 24 hours, as per Stocktwits data.

During the first half of the year, the firm’s profits rose 24% YoY to RMB13.6 billion (approximately $1.9 billion), implying a slowdown in profit growth. The company’s first half profits in 2023 had witnessed a three-fold rise.

The slowdown comes at a time when Chinese EV firms are cutting prices to boost sales while the economy remains weak and consumer demand sluggish.

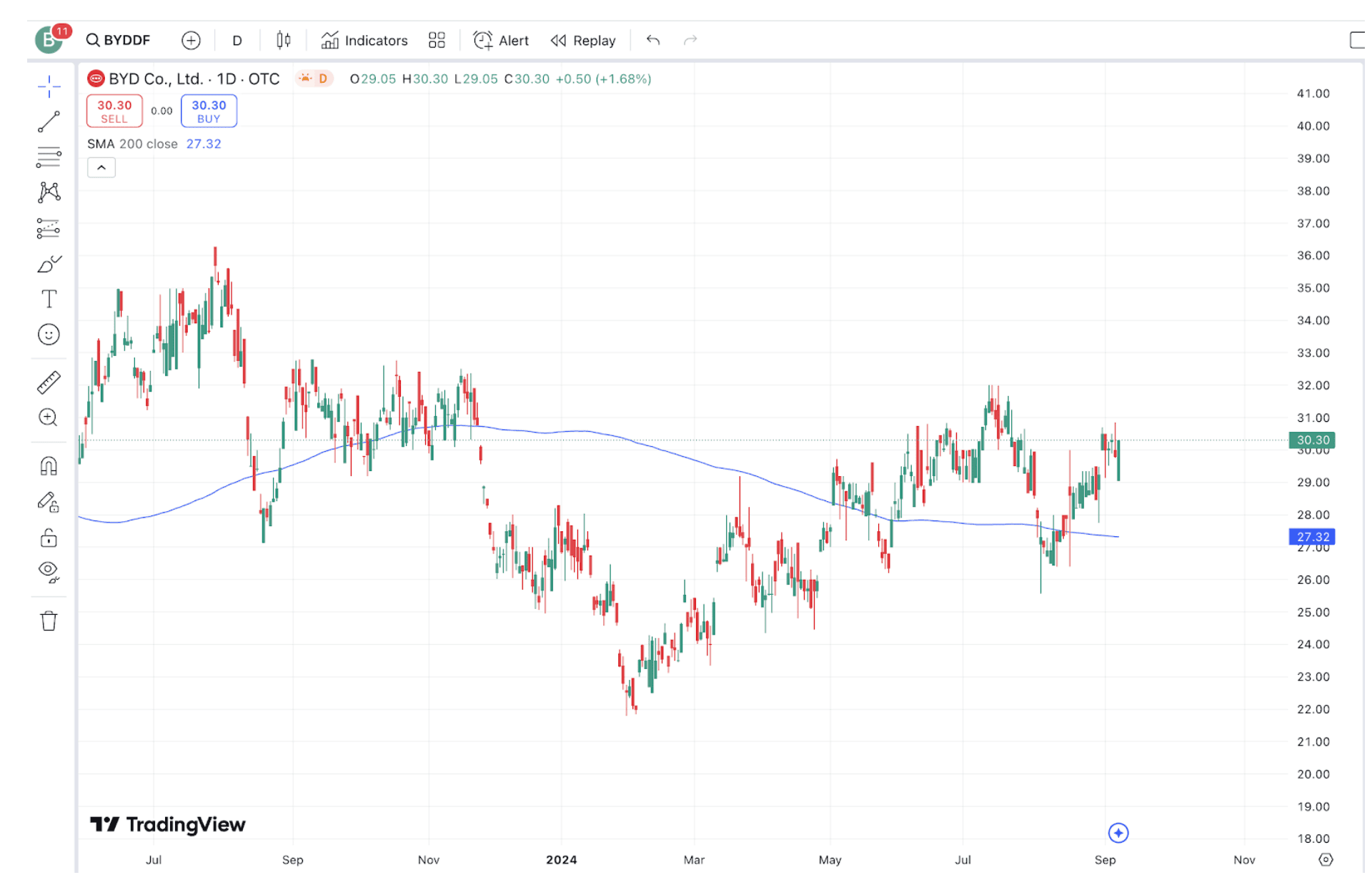

BYD shares have gained over 12% this year so far. The stock, which is currently trading near the $30-mark, is significantly below its June 2022 highs of about $43. At present, the shares are trading above its 200-day moving average.

Source: Trading View

Also See: Goldman Sachs Stock Falls Pre-Market After CEO David Solomon Flags $400M Q3 Revenue Hit

/filters:format(webp)https://news.stocktwits-cdn.com/large_kalshi_logo_jpg_d4ea268948.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2203138957_jpg_dd735f9905.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1249125319_jpg_31d1207b8e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235778544_jpg_2b7ceca102.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tilray_Brands_jpg_add037e8e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)