Advertisement|Remove ads.

Who Will Trump Pick As Next Fed Chair? Here’s What Prediction Markets Show

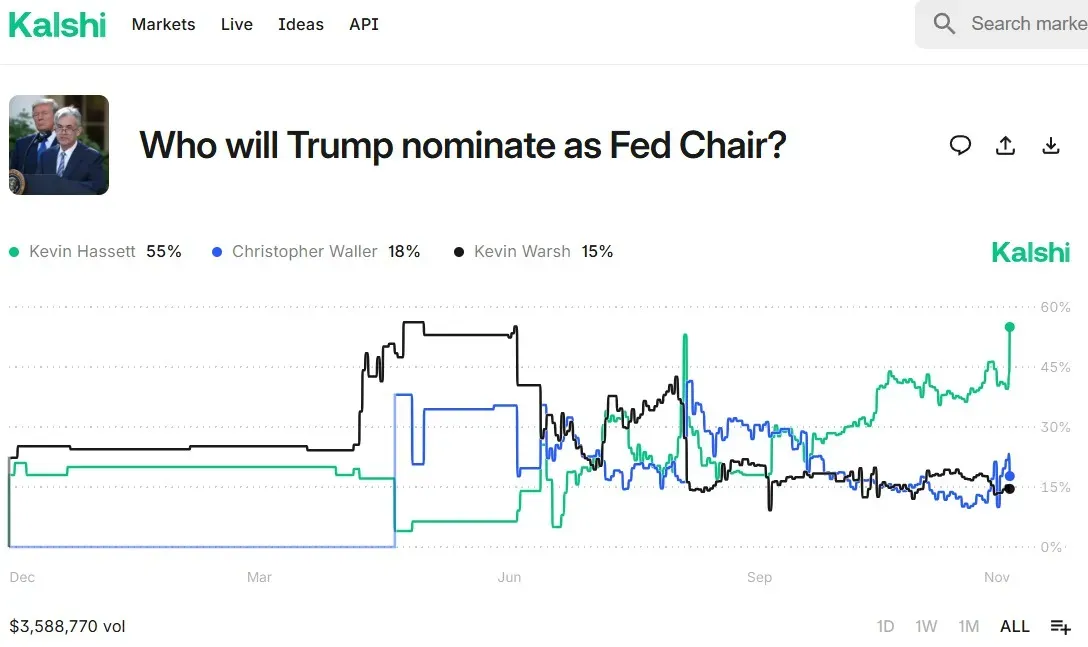

- Data from Kalshi shows that there is a 55% probability of Hassett emerging as the Fed Chair pick, while participants on Polymarket were relatively less optimistic.

- While Treasury Secretary Scott Bessent has stated that President Donald Trump could name the Fed Chair nominee before Christmas, there’s no official timeline announced by the Trump administration yet.

- Apart from Hassett, ex-Fed official Kevin Warsh, current central bank governor Christopher Waller, Fed Vice Chair for Supervision Michelle Bowman, and BlackRock’s Rick Rieder are the potential Fed Chair candidates.

Prediction markets are buzzing with bets on who will be the next Chair of the Federal Reserve, following a report on Tuesday that current White House National Economic Council Director Kevin Hassett is being seen as the frontrunner to succeed Jerome Powell.

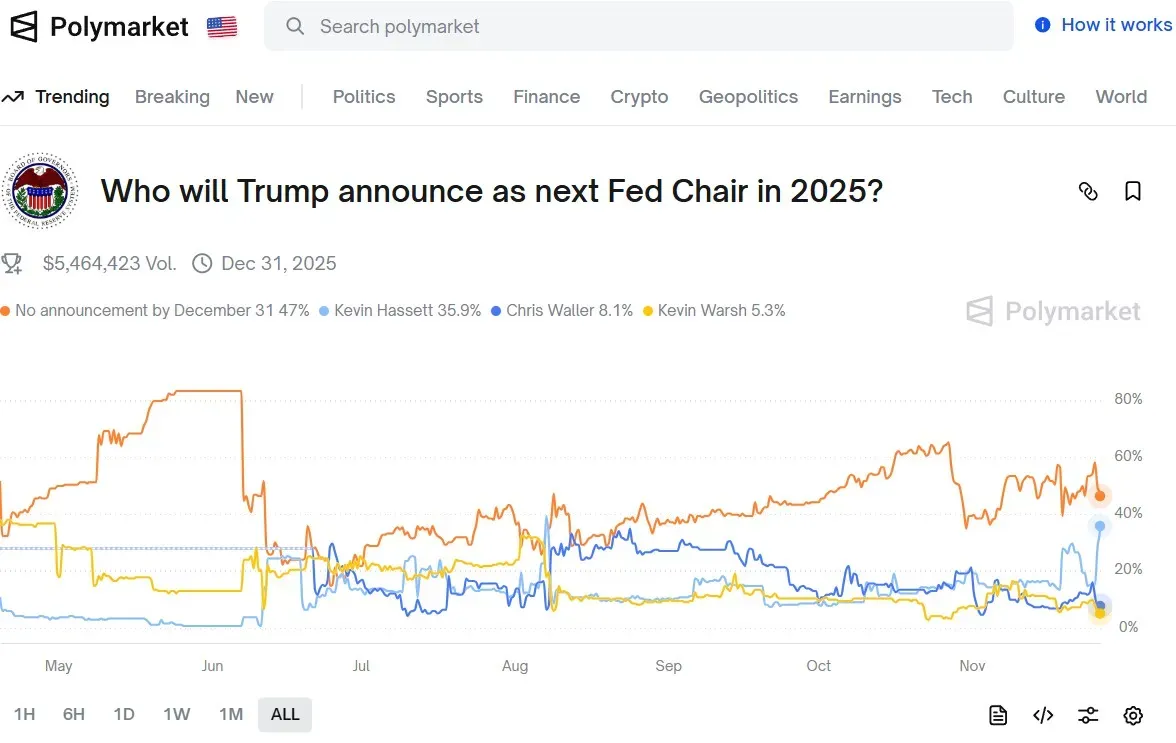

Data from popular prediction markets Kalshi and Polymarket show that bets regarding the Fed Chair pick on both platforms are now worth over $9 million. While Kalshi volumes show bets worth more than $3.59 million, Polymarket bets had reached a total of over $5.46 million at the time of writing.

What Are Prediction Markets Saying?

Data from Kalshi shows a 55% probability that Hassett will emerge as the Fed Chair pick. Participants on Polymarket were relatively less optimistic, with data indicating a 36% probability that Hassett would be picked as the Fed Chair at the time of writing.

While Treasury Secretary Scott Bessent has stated that President Donald Trump could name the Fed Chair nominee before Christmas, the Trump administration has not yet announced an official timeline.

The Polymarket poll shows a 47% probability that President Trump will not announce his nominee before December 31.

Trump’s Potential Fed Chair Picks

Apart from Hassett, President Trump’s potential picks for the Fed Chair position include ex-Fed official Kevin Warsh, current central bank governor Christopher Waller, Fed Vice Chair for Supervision Michelle Bowman, and BlackRock Inc.’s Rick Rieder.

Bessent had previously stated that there are 11 candidates in the list and that he would narrow it down before presenting it to President Trump.

Powell’s Term Ends May 2026

Jerome Powell’s term as the Fed Chair ends in May 2026, while his term as the central bank’s governor ends in 2028. Powell can either step down from the Fed entirely when his term as chair expires in May 2026 or stay on as governor until 2028.

If Powell steps down, that would allow President Trump to have four appointees on the Fed’s Board of Governors. The seven-member board, along with five regional Federal Reserve presidents, votes during the Federal Open Market Committee (FOMC) meetings.

Meanwhile, U.S. equities gained in Wednesday’s pre-market trade. At the time of writing, the SPDR S&P 500 ETF (SPY), which tracks the S&P 500 index, was up by 0.32%, the Invesco QQQ Trust ETF (QQQ) rose 0.47%, while the SPDR Dow Jones Industrial Average ETF Trust (DIA) gained 0.22%. Retail sentiment around the S&P 500 ETF on Stocktwits was in the ‘bearish’ territory.

The iShares 7-10 Year Treasury Bond ETF (IEF) was down by 0.11% at the time of writing.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_x_0d62438a6d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Circle_Internet_jpg_add0182c9c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1227710498_jpg_fbb12d04bf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)