Advertisement|Remove ads.

Goldman Sachs Stock Falls Pre-Market After CEO David Solomon Flags $400M Q3 Revenue Hit

Goldman Sachs Group (GS) CEO David Solomon reportedly stated that the bank will take a hit of approximately $400 million to its revenue as it unwinds its consumer business. The impact comes in the wake of the bank’s unwinding of its GM Card business and a separate portfolio of loans.

Shares of the firm were trading 0.57% lower in Tuesday’s pre-market session as of 7:19 a.m. ET. Solomon also said that trading revenue for the current quarter will decline by 10% due to a tough year-over-year comparison and non-conducive trading conditions last month for fixed-income markets.

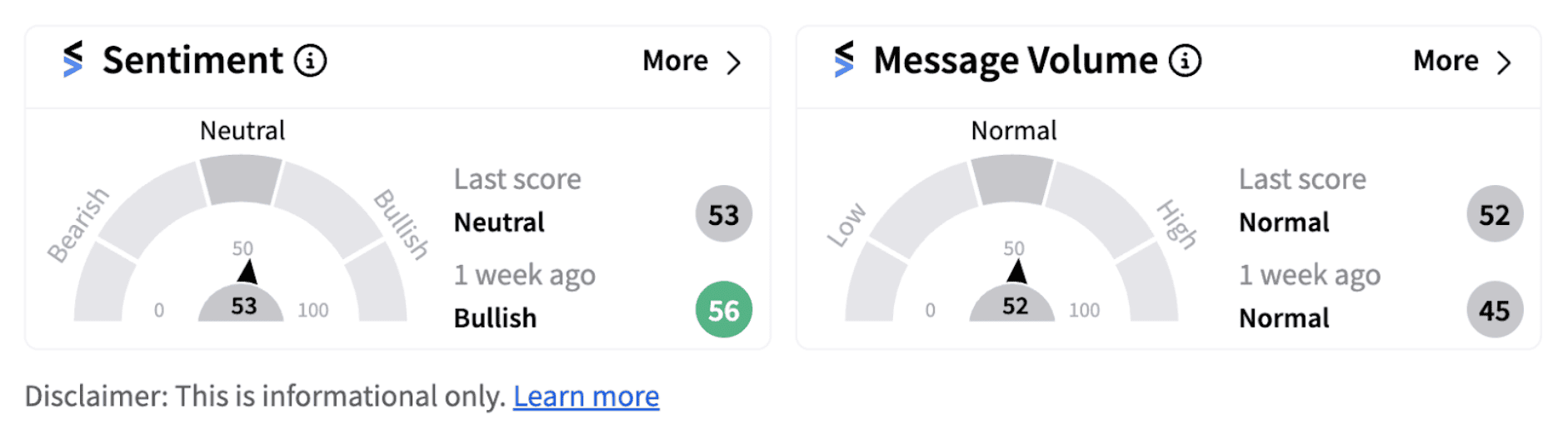

Following the development, retail sentiment on Stocktwits trended in the ‘neutral’ territory (53/100).

Goldman Sachs had reportedly commenced a pivot away from its consumer operations that saw a series of write-downs because of the sale of parts of the business. The bank is now focusing on its asset and wealth management segment. Indeed, net revenues in the segment rose 27% year-over-year (YoY) to $3.88 billion during the second quarter of 2024.

The CEO’s comments have been the talking point among Stocktwits followers with one bearish user believing the banking sector is over-valued at the moment.

Last month, The Wall Street Journal reported that Goldman Sachs is planning to cut between 3% and 4% of its global workforce as part of its annual review. That would amount to between 1,300 and 1,800 jobs, the report said.

Goldman usually aims to reduce between 2% and 7% of its workforce based on a variety of parameters but the range has fluctuated over the years, the report added.

Although the $400 million hit to the revenue coupled with trading revenue decline may have hit investor confidence, it is worth noting that the bank’s exposure to consumer loans have been coming down significantly, helping improve its overall performance.

During the second quarter, the bank had topped Wall Street estimates with earnings per share (EPS) coming in at $8.62 versus an estimated $8.34 and revenue coming in at $12.73 billion compared to an estimate of $12.46 billion. The stock, too, has reflected the positive sentiment, returning over 25% this year.

/filters:format(webp)https://news.stocktwits-cdn.com/large_opendoor_OG_jpg_55300f4def.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_federal_reserve_jpg_7298dc8578.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_generic_resized_jpg_3444b70edf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_snap_resized_jpg_9672f61595.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_kalshi_logo_jpg_d4ea268948.webp)