Advertisement|Remove ads.

Canadian Natural Resources Keeps Retail Traders Bullish With Dividend Hike Even As Q4 Profit Shrinks

Canadian Natural Resources’ (CNQ) U.S. shares garnered retail attention on Thursday after the company raised its dividend despite a slump in fourth-quarter earnings.

Its net earnings fell to C$1.14 billion ($795.6 million), or C$0.58 per share, for the fourth quarter, compared to C$2.63 billion, or C$1.21 per share, a year earlier.

Oil prices declined in the fourth quarter compared to a year earlier, as demand concerns and growing supply from non-OPEC countries outweighed the impact of tensions in the Middle East.

According to FactSet data, the oil and gas producer posted adjusted earnings of C$0.93 per share for the quarter ended Dec. 31, which was in line with estimates.

However, the company’s average quarterly production surged to a record 1.47 million barrels of oil equivalent per day (boe/d) compared with 1.42 million boe/d, a year earlier, aided by robust Oil Sands Mining and Upgrading production.

Canadian Natural raised its quarterly dividend by 4% to C$0.59. The company had raised its quarterly dividend twice in 2024.

The Calgary, Alberta-based company has completed several acquisitions over the past few months to boost its production.

In December, Canadian Natural closed its deal to acquire Chevron’s Alberta assets for $6.5 billion. Earlier this year, the company swapped Shell’s remaining 10% working interest in the Albian mines for a 10% working interest in the Scotford Upgrader and Quest Carbon Capture and Storage facilities.

The company said it would raise its 2025 production forecast by 31,000 barrels per day (bpd) following the closing of the asset swap deal with Shell.

Concerns have grown around Canada’s oil exports to the U.S. after President Donald Trump levied 10% tariffs on energy products alongside 25% tariffs on all Canadian goods.

Canadian Natural said, in December, it boosted its shipments in the Trans Mountain Expansion pipeline to 169,000 bpd. The pipeline carries oil from landlocked Alberta to Canada’s west coast, enabling shipments to Asian refineries.

The company's president, Scott Stauth, told Reuters in an interview that Canada should consider even larger and more long-term project opportunities to create broader markets for its oil, even outside of North America.

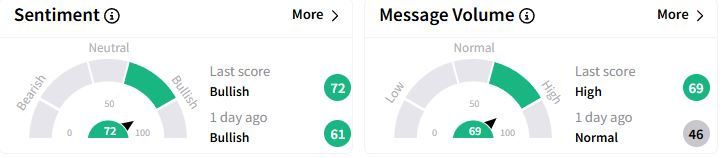

Retail sentiment on Stocktwits moved higher into the ‘bullish’ (72/100) territory than a day ago, while retail chatter rose to ‘high.’

One user was surprise by another dividend hike.

Over the past year, Canadian Natural’s shares have fallen 22.9%.

1 Canadian dollar (C$) = $0.70

Also See: Walgreens Boots Alliance Confirms $10B Go-Private Deal: Retail’s Extremely Bullish

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Circle_Internet_jpg_add0182c9c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1227710498_jpg_fbb12d04bf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)