Advertisement|Remove ads.

Canara Bank Swing Trade: SEBI RA Kavita Agrawal Sees 15% Upside In This ‘Supertrender’

Canara Bank stock has a 15% upside potential if entry is made at ₹105, according to SEBI-registered analyst Kavita Agrawal.

The analyst describes the stock as a “supertrender,” meaning it tends to sustain long rallies once it turns bullish. She believes the current price action signals a potential breakout ahead.

While there could be a minor dip in the stock price in the short term, it does not indicate a trend reversal, but rather a healthy correction, Agrawal added.

For a swing-trade setup, she identified the ₹102-₹105 zone as the ideal entry price, with a target price of ₹120, an 11.1% premium to the current price of ₹108, and stop loss at ₹101.45.

For traders seeking a momentum-based approach, Agrawal suggests entering at ₹107 with a target of ₹121. She cautioned a stop loss at the entry point of ₹107.

The stock has a risk-reward ratio of 1:4, the analyst added. With a potential upside of around 15%, Canara Bank stands out as a high-conviction swing trade candidate.

At the time of writing, Canara Bank’s shares were up 3.1%.

Fundamentally, Canara Bank delivered strong quarterly results, reporting a 33% jump in standalone net profit, a 7.6% increase in interest income, and a 57 basis point improvement in net non-performing assets (NPA).

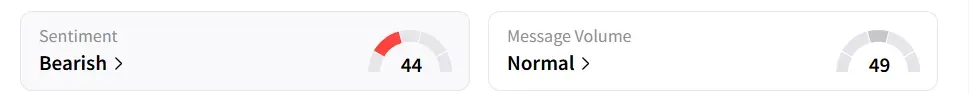

Retail sentiment on Stocktwits turned 'bearish' from 'neutral' a day earlier.

Over the past three months, the stock has seen a healthy growth of nearly 26%. Year-to-date, the shares were up 7.8%

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235778544_jpg_2b7ceca102.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243050664_jpg_37b52748e2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_natural_gas_plant_resized_jpg_e43db2dc7b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)