Advertisement|Remove ads.

Capri Holdings In Spotlight As Prada Reportedly Nears $1.6B Versace Deal: Retail Chatter Tilts Bullish Ahead Of New Week

Shares of Capri Holdings (CPRI) will likely draw investor attention on Monday after a report over the weekend indicated that Italy's Prada (PRDSY) has advanced in negotiations to acquire Versace for about €1.5 billion ($1.6 billion).

Bloomberg, citing people familiar with the matter, reported that Prada and Capri could finalize a deal for the Italian luxury clothier this month.

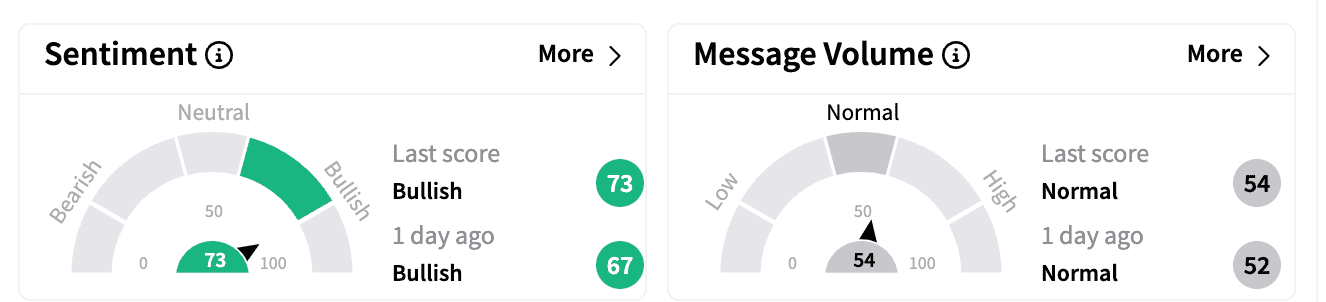

Retail sentiment on Stocktwits for Capri ended Friday on a 'bullish' note, while message volume remained in 'normal' territory.

Ahead of Monday's market open, fresh chatter on the platform indicated optimism, with one user wondering if the stock would hit $30 while another claimed to have placed an order for 300 shares on the news.

Prada reportedly emerged as a potential buyer in January after Capri put Versace up for sale following its failed $8.5 billion merger with Tapestry.

Reuters reported that talks progressed after initial due diligence revealed no significant risks.

The deal is expected to close this month, though its final value and timing remain uncertain.

Capri, which also owns Michael Kors and Jimmy Choo, hired Barclays to explore strategic options after the collapse of its Tapestry merger, which was blocked by the Federal Trade Commission in November.

Separately, Capri recently raised its long-term guidance, forecasting $4.4 billion in revenue for 2025 — slightly above Wall Street estimates.

The stock has gained more than 6% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

EUR 1 = $1.03

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227347257_jpg_81c3539d3f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2204003106_jpg_405e036a7c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ondas_OG_jpg_05cf209e61.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_peter_tuchman_jpg_fb781e7355.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243967992_jpg_85ede3fab5.webp)