Advertisement|Remove ads.

CarGurus Stock Slides After Mixed Q4 Results, Weak Guidance: Retail Mood Worsens

CarGurus, Inc. (CARG) stock fell in Thursday’s after-hours session after the online automotive platform for buying and selling vehicles, reported mixed quarterly results and issued subpar guidance for the first quarter.

The Boston, Massachusetts-based company reported fiscal year 2024 fourth-quarter adjusted earnings per share (EPS) of $0.55, up from the year-ago quarter’s $0.35 and exceeding the Finchat-compiled consensus of $0.55.

Revenue climbed 2% year over year (YoY) to $228.5 million, missing the consensus estimate of $231.72 million. Marketplace revenue rose 15% to $210.2 million, while wholesale and product revenues declined 55% each.

CEO Jason Trevisan said, “Our Marketplace business achieved double-digit growth, driven by continued migration to premium tiers, strong OEM advertising demand, and growing adoption of our value-added products and services.”

Among key performance indicators, total paying dealers increased 3%, and Quarterly Average Revenue per Subscribing Dealer (QARSD) gained 12% to $6,144.

CarGurus expects first-quarter adjusted EPS of $0.41-$0.47, and revenue of $216 million to $236 million, with $209 million to $214 million expected from the marketplace. The top-line guidance trailed the $239.10-million consensus estimate.

The bottom-line guidance was at $0.41-$0.47, in line with the $0.42 per share consensus estimate.

CarGurus said in 2025, it looks ahead to leverage its data-driven actionable insights and unique ability to deliver dealer-specific competitive intelligence.

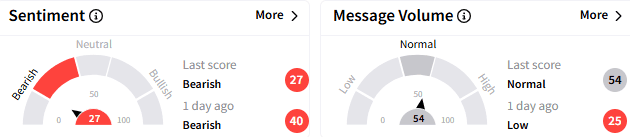

On Stocktwits, sentiment toward

A bearish watcher said the big revenue miss warranted a 20% stock plunge.

Another user pointed out that CarGurus performance was subpar despite a strong car market in the December quarter.

The stock shed 6.89% before ending Thursday’s after-hours session at $35. It has added about 3% year-to-date.

For updates and corrections, email newsroom@stocktwits.com

Read Next: Dropbox Stock Slumps As Downbeat Guidance Takes Sheen Off Q4 Beat: Retail Confidence Nosedives

/filters:format(webp)https://news.stocktwits-cdn.com/large_esperion_therapeutics_jpg_67c560225d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_amazon_walmart_jpg_05c61e928f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228864541_jpg_d94770c5a8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Bury_resized_jpg_14e6fc7c2b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_capricor_jpg_9f4f8ab098.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)