Advertisement|Remove ads.

CarParts.com’s Retail Chatter Spikes After Company Explores Strategic Options Including Potential Sale

Shares of CarParts.com (PRTS) surged 18% in the past five days as the company announced it was exploring strategic alternatives, including a possible sale, prompting a surge in retail chatter.

CarParts initiated the process in response to inbound strategic inquiries and has engaged Craig-Hallum Capital Group as its financial advisor.

The automotive parts retailer has not set a timeline for the completion of the exploration of strategic alternatives

“Our future as an independent company is bright,” said David Meniane, CEO of CarParts.com. “At the same time, we are committed to evaluating a range of strategic alternatives to maximize value for our shareholders."

Meniane noted the company has made significant investments in building a vertically integrated supply chain with a nationwide fulfillment network.

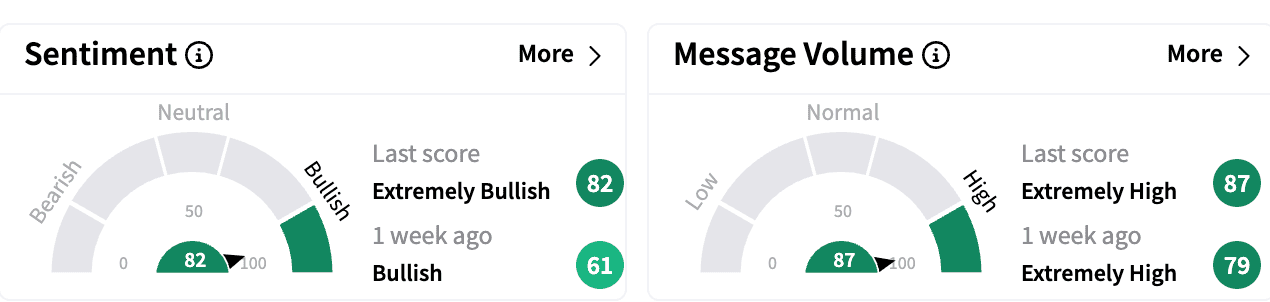

Retail sentiment on Stocktwits around the stock was in the ‘extremely bullish’ (82/100) territory, rising from ‘bullish’ a week ago. Message volumes remained at ‘extremely high’ levels.

One bullish commenter was hopeful about a $5-a-share offer price.

Following the announcement, Craig-Hallum’s research arm upgraded CarParts to ‘Buy’ from ‘Hold’ with a $3 price target, The Fly reported.

According to the firm, the company has a strong balance sheet, significant asset value and low valuation, and it was logical for the company to consider strategic alternatives, adding it could offer either a private equity or strategic buyer value.

In January, the Nasdaq notified the company about regaining compliance with the exchange’s minimum bid price requirement. The notification confirmed its shares had a closing bid price at or above $1 per share for 10 consecutive business days, from Dec. 30 to Jan. 14.

Torrance, Calif.-based CarParts.com sells over one million automotive parts and accessories.

Its stock is up 3.7% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2213364581_jpg_86d1ff954e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_cathiewood_OG_jpg_a3c8fddb3f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Micron_jpg_7058d4986a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2249765235_jpg_8d9471024c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Getty_Images_2185805420_fotor_2025011795638_6fbb0bb63f.jpg)