Advertisement|Remove ads.

Carrier Global Stock Slips After Q4 Revenue Miss: Retail Finds Joy In Profit Beat

Carrier Global (CARR) stock fell 1.9% Tuesday after the company’s fourth-quarter revenue missed Wall Street’s estimates.

According to FinChat data, the company reported quarterly sales of $5.15 billion, compared with the average analysts’ estimate of $5.20 billion.

On an adjusted basis, the company reported earnings of $0.54 per share for the three months ended Dec. 31, compared with the Street estimate of $0.48 per share.

“We are well-positioned to deliver strong results in 2025, reinforced by our growing global commercial HVAC backlog supported by the acceleration in data centers, commitment to double-digit aftermarket growth, and leading positions across our businesses,” CEO David Gitlin said.

The company said sales in its HVAC (heating, ventilation, and air conditioning) segment rose 11% organically.

Its Americas sales in the HVAC segment grew organically by the high teens percentage points, helped by continued strength in commercial and North American residential sales, up double-digit percentage points.

Carrier said that its refrigeration sales were down 6% organically, hurt by declines in sales to trucks and trailers in North America.

The Florida-based company forecasts 2025 net sales between $22.5 billion and $23 billion. It expects a $750 million sales hit in commercial refrigeration divestiture.

Carrier expects to buy back shares worth about $3 billion in 2025.

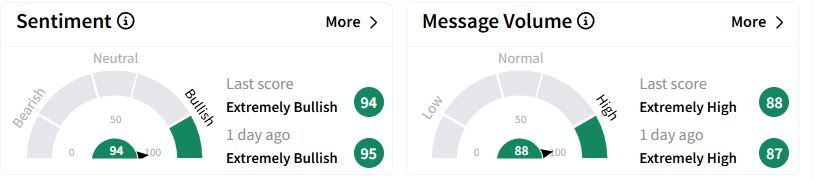

Retail sentiment on Stocktwits remained in the ‘extremely bullish’ (94/100) territory while retail chatter was ‘extremely high.’

Carrier said its 2025 focus would remain on high-efficiency residential and commercial heat pumps, data center portfolio expansion, and transport electrification.

Over the past one year, Carrier stock has fallen 16.6%.

Also See: Carlyle Group Stock Slips After Q4 Profit Miss: Retail Remains Neutral

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_bitcoin_red_resized2_4b1c608f3a.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218096576_jpg_5f8f72424d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_eli_lilly_logo_resized_9e8a8a2333.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sunrun_resized_78420391c3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2216742392_jpg_6f9d355647.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222819201_jpg_edcbb1336e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Ram_83262cba1d.jpg)