Advertisement|Remove ads.

Carlyle Group Stock Slips After Q4 Profit Miss: Retail Remains Neutral

Carlyle Group (CG) stock fell 5.2% on Tuesday after the company’s fourth-quarter profit missed Wall Street’s estimates.

The alternative asset manager reported distributable earnings of $0.92 per share, compared with the average analysts’ estimate of $0.95 per share, according to FinChat data.

However, fourth-quarter revenue of $1.03 billion topped the Street estimate of $980.3 million.

The company’s fee-earning assets under management (AUM) fell by 1% to $304 billion, compared with last year, driven by an 8% fall in global private equity from outflows in funds that charge fees on invested capital and basis point step-downs.

It was partially offset by a 14% increase in fee-earnings AUM at the global investment solutions business.

The company’s total AUM rose 4% to $441 billion, helped by an 11% rise in global investment solutions attributable to inflows, notably in its AlpInvest Secondaries & Portfolio Finance and CAPM funds.

Carlyle said its fee-related earnings rose 13% to $287 million compared to the year-ago quarter.

The private equity firm recorded inflows of $14.2 billion during the fourth quarter and $40.8 billion in 2024.

Total AUM in its global private equity and global credit segments declined quarter-over-quarter.

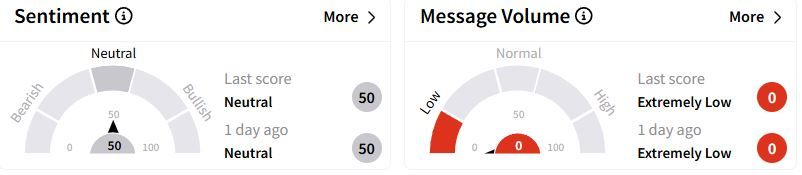

Retail sentiment on Stocktwits remained in the ‘neutral’ (50/100) zone while retail chatter bottomed in ‘extremely low’ territory.

Earlier in February, peers Apollo Global Management and KKR had topped fourth-quarter profit estimates.

Over the past year, Carlyle stock has gained 8.9%.

Also See: S&P Global Stock Hits All-Time High After Q4 Profit Tops Estimates: Retail’s Elated

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2166123192_jpg_1bb818cd90.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_qualcomm_logo_OG_jpg_b2a06ae10a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_mcdonalds_store_jpg_130260f7da.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2258839311_jpg_35f0914ce1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_RKLB_f09e0d1df7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Logo_Robinhood_png_254150c47e.webp)