Advertisement|Remove ads.

Carvana Set Up For Strong Q2, Analysts Say, As Used Car Sales Boom In Trump-Tariff Era

Analysts expect Carvana (CVNA) to report strong revenue and profit growth for the last quarter, signaling continued interest in used cars.

Revenue is projected to climb over 34% to $4.59 billion in the second quarter, while adjusted profit is expected to surge nearly 200% to $1.14 per share, according to Koyfin data. The company will report after the stock market closes on Wednesday.

Carvana shares have surged 65% this year, driven by growing consumer demand for affordable vehicles, including used cars, as buyers seek to hedge against the threat of rising prices resulting from U.S. tariffs.

In a recent note, Wedbush noted particular momentum in Carvana's retail segment, as well as better per-unit profitability. The research firm expects gross profit per unit to be about $7,327, which is about 2% higher than current analyst expectations.

Carvana has worked to restructure its balance sheet and improve cost efficiencies at the chain, which has allowed it to deliver sustained profitability, Oppenheimer said in a note. The brokerage upgraded its rating on the company's shares to 'Outperform' last week.

Carvana set ambitious long-term targets in May, which include selling 3 million vehicles annually at an adjusted EBITDA margin of 13.5% within the next five to 10 years.

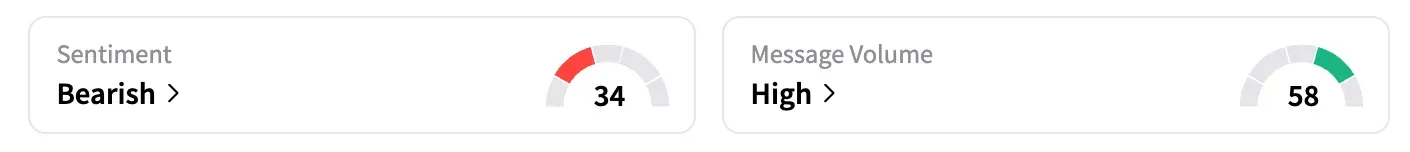

On Stocktwits, the retail sentiment for the company's shares remained 'bearish,' unchanged from a week ago. Some users were considering shorting the stock following the recent rally, ahead of the company's earnings report on Wednesday.

Meanwhile, although it has had little bearing on the company's stock, Chairman Ernest C. Garcia II has been selling his shares at a rapid pace. Including an over $50 million sale this month, he has cumulatively sold shares worth nearly $300 million this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Beyond Shares Jump After Strong Q2 Print, Signaling Revival

/filters:format(webp)https://news.stocktwits-cdn.com/large_new_york_stock_exchange_jpg_e1f85c0d8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Netflix_jpg_8bc1596785.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2239888469_jpg_5e0e3b606c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_vir_biotech_jpg_f43ff73654.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2170386387_jpg_600d460275.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2228900989_jpg_e94daec744.webp)