Advertisement|Remove ads.

Carvana Chairman Cashes Out Again — But Retail Traders Aren’t Flinching

Ernest C. Garcia II, father of Carvana co-founder and CEO Ernest Garcia III, and a significant shareholder in the company, is selling shares of the used car retailer at a rapid clip.

Garcia Sr., who serves as chairman of the board at Carvana, has sold shares worth $52.3 million in transactions made last Thursday, according to an exchange filing on Monday.

In transactions over May, June, and this month, he has cumulatively sold company shares worth about $290 million.

Last year, he offloaded company stock worth approximately $360 million, with most of the sales occurring in the latter half of the year.

Top company insiders occasionally sell shares to gain liquidity; however, this may be construed as a negative signal for the stock. However, the market hasn't paid heed in this case.

Carvana shares have surged more than 70% this year, driven by growing consumer demand for affordable vehicles, including used cars, as buyers seek to hedge against the threat of rising prices resulting from U.S. tariffs.

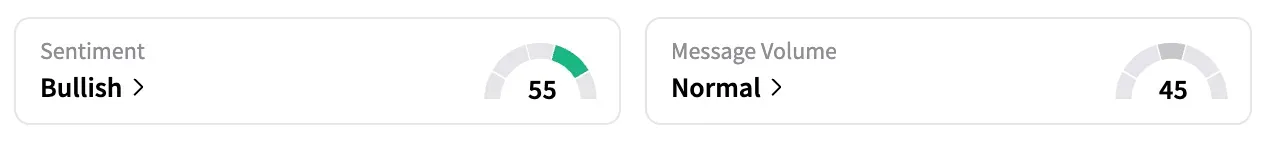

On Stocktwits, the retail sentiment for CVNA shifted to 'bullish' from 'neutral' the previous day.

Garcia II gained his stake in Carvana through its 2012 spin-off from DriveTime Automotive, the used-car retail and finance company he founded in 2002, and has retained control through subsequent equity and debt restructurings.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Is Opendoor The Next GameStop? Penny Stock Triples In A Week, Retail Frenzy Takes Hold

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2158238458_jpg_48ab7af27c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_market_OG_2_jpg_d58f0a637e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_supermicro_resized_jpg_95d12828d5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ray_dalio_resized_jpg_d2f1d535bc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_pharma_stock_jpg_490939e580.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_jamie_dimon_jpmorgan_jpg_cbdd07fa63.webp)