Advertisement|Remove ads.

Carvana Stock Rallies Pre-Market After Jefferies’s Upgrade, Price Target Hike

Jefferies upgraded Carvana (CVNA) to ‘Buy’ from ‘Hold’ on Wednesday, sending shares of the company rallying over 1% in the pre-market session despite weakness in the broader market stemming from the uncertainty around the U.S. government shutdown.

The analyst also hiked the price target on the stock to $475, up from $385.. The new price target represents an upside of about 26% from the stock’s last closing price on Tuesday.

The firm says the results of its consumer survey, web scape, and capacity analysis suggest Carvana will continue to deliver elevated growth and upside to consensus estimates. In addition, the company's fixed cost leverage will help supplement its revenue growth, supporting further expansion in unit economics and "peer-high" Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) growth, the analyst told investors in a research note, as per TheFly.

Jefferies further believes Carvana is best positioned to benefit from a "nascent shift to digital in the massive $800B used car market."

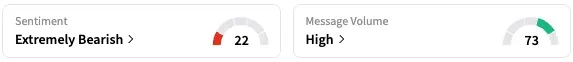

On Stocktwits, retail sentiment around CVNA stock fell to ‘extremely bearish’ from ‘bearish’ territory over the past 24 hours, while message volume stayed at ‘high’ levels.

On Tuesday, Carvana had announced the launch of same-day delivery in the greater San Francisco Bay Area on the heels of Seattle, the Greater Chicago Area, and other regions, in a bid to raise its appeal to customers in the used car market. With Carvana, customers can find a car, get financing, trade in, and complete a purchase entirely online.

In the second quarter (Q2) through the end of June, Carvana sold 143,280 retail units, marking a growth of 41% year-over-year, for a total revenue of $4.84 billion, an all-time quarterly record. The company said in July that it expects a sequential increase in retail units sold in the third quarter (Q3) as well.

According to data from Koyfin, 14 of the 22 analysts covering CVNA rate it ‘Buy’ or higher, while seven rate it ‘Hold’ and one ‘Sell.’ The average price target on the stock is $421.95, representing an upside of nearly 12% from the last closing price.

CVNA stock is up by 86% this year and has more than doubled its value over the past 12 months.

Read also: Tesla Hikes Model Y And Model 3 Lease Prices In US After EV Tax Credit Expiry

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Netflix_jpg_8bc1596785.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2239888469_jpg_5e0e3b606c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_vir_biotech_jpg_f43ff73654.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2170386387_jpg_600d460275.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2228900989_jpg_e94daec744.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669423_jpg_f410427536.webp)