Advertisement|Remove ads.

Carvana Stock Slides Despite Q4 Earnings Beat: Retail Feels Dip Isn't Worth Buying

Shares of Carvana Co. (CVNA) slipped more than 9% in after-hours trading on Wednesday even as the company posted better-than-expected fourth-quarter earnings, but retail sentiment turned bearish.

The used car retailer’s Q4 earnings per share were $0.64, beating estimates of $0.30. Revenues were $3.55 billion, up 46% year over year, beating Wall Street expectations of $3.34 billion.

Its 2024 revenue stood at $13.67 billion, up 27% from a year earlier.

For Q4, net income stood at $159 million, and adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) reached $359 million. For 2024, its adjusted EBITDA came in at $1.38 billion and net income at $404 million.

The company expects a "strong 2025" with "significant growth in both retail units sold and Adjusted EBITDA," including a sequential increase in retail units sold and Adjusted EBITDA in Q1 2025. However, it didn't provide specific numbers.

A MarketWatch report also pointed out that Carvana's Q4 per-unit revenue for retail vehicles fell to $22,312 from $23,354 a year earlier, roughly meeting company expectations.

Separately, Carvana has reportedly amended its "at-the-market" offering program, entering into a second amended and restated distribution agreement with Barclays Capital, Citigroup, and Virtu Americas. According to The Fly, the company plans to sell up to the greater of $1 billion worth of Class A common stock or 21,016,898 shares, issuing them periodically under the revised agreement.

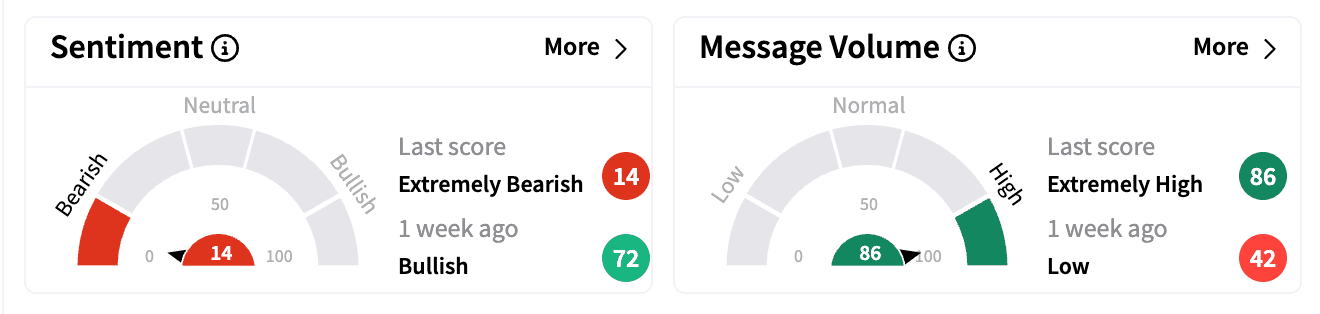

Sentiment on Stocktwits turned 'extremely bearish' from 'bullish' a week ago, with many commenters questioning the lack of specifics in its guidance. Message volume moved to 'extremely high' from 'low.'

One bearish commenter on the Stocktwits platform was concerned about the company "aggressively" diluting its shares and said the EPS will "quickly go back to nickels and dimes."

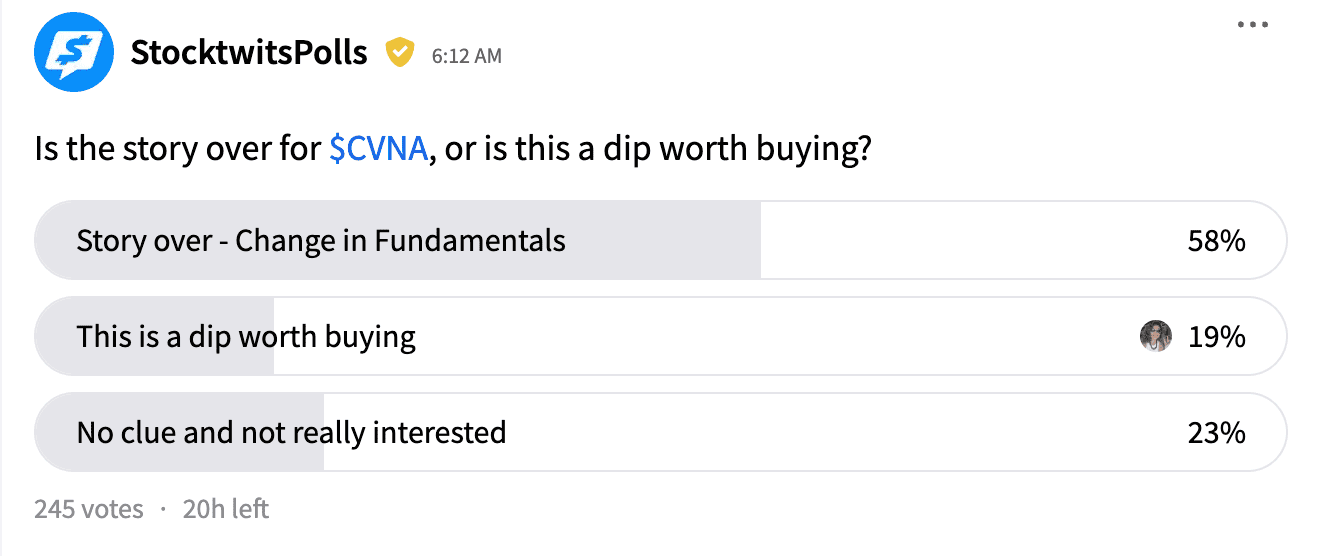

Early results from a Stocktwits poll show that 59% of respondents think the post-earnings dip isn't a buying opportunity, voting for "Story over – Change in Fundamentals," while only 19% see it as worth buying.

Carvana stock is up 39% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_novavax_vaccine_resized_455cef63e9.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Array_Tech_b34d437c86.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_stock_jpg_9eab8bde17.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250929477_jpg_725f832b99.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1238344200_1_jpg_9ec6a1a77a.webp)