Advertisement|Remove ads.

Casey’s General Stores Gets Analyst Upgrade Ahead of Q3 Earnings: Retail Stays Bullish

Shares of convenience chain Casey’s General Stores were up over 1.6% on Thursday after the company received an upgrade from Gordon Haskett ahead of its third-quarter earnings, lifting retail sentiment.

Gordon Haskett analyst Chuck Grom upgraded Casey's to ‘Buy’ from ‘Hold’ with a price target of $500, up from $410, Fly.com reported. The decision was based on both updated near-term data observations that showed an upside for the quarter and a macro view of the business, said the report.

Gordon Haskett raised its Q3 earnings per share forecast to $2.10 from $1.79 and its FY25 and FY26 EPS forecasts to $14.30 and $16.20, respectively, added the report.

Wall Street analysts expect Casey’s to post earnings per share of $2.06 on revenue of $3.76 billion, according to Stocktwits data.

Last month, BMO Capital resumed coverage of Casey's General Stores with a 'Market Perform' rating with a price target of $450, up from $400, Fly.com reported. According to the firm, Casey's had executed exceptionally well on several fronts in recent years, driving same-store sales outperformance relative to convenience-store peers, added the report.

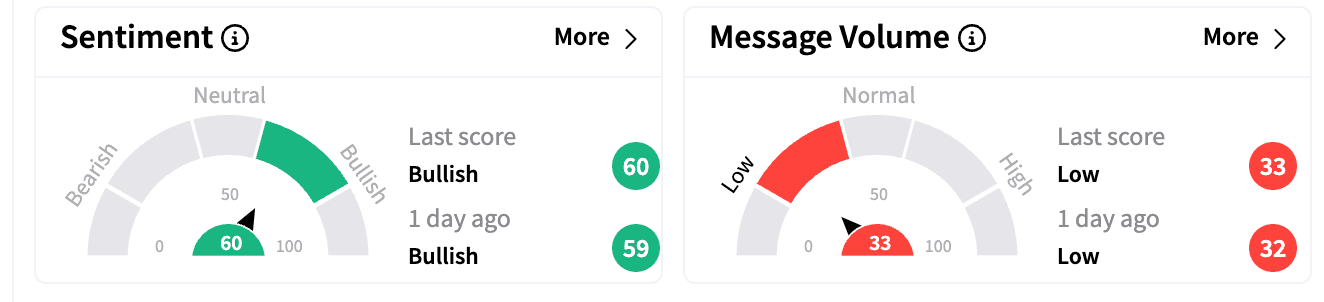

Sentiment on Stocktwits inched up in the ‘bullish’ one. Message volumes were in the ‘low’ territory.

In Q2, Casey’s reported diluted earnings per share (EPS) of $4.85, up 14% from the same period a year ago and above the Wall Street estimates of $4.29. The company’s revenue stood at $3.95 billion, missing estimates of $4.03 billion. Inside same-store sales increased 4% compared to the same period last year, with an inside margin of 42.2%.

Last quarter, it also declared a quarterly dividend of $0.50 per share.

"Casey's delivered a strong second quarter highlighted by robust inside gross profit growth,” Darren Rebelez, chair, president, and CEO, said at the time of the last earnings, adding the company’s same-store sales were driven by the prepared food and dispensed beverage category, with hot sandwiches and cold dispensed beverage performing exceptionally well.

Casey’s stock is up 11.7% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1227710498_jpg_fbb12d04bf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227231004_jpg_0de480c6f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254924041_jpg_892ccf911d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1234736300_jpg_881ee00045.webp)