Advertisement|Remove ads.

Cathie Wood's ARK Invest Buys More Amazon Stock: Retail Still On The Sidelines

Cathie Wood's Ark Investment Management has increased its stake in Amazon.com (AMZN) by purchasing another $6.2 million worth of shares, according to its disclosure on Tuesday.

ARK Next Generation Internet ETF (ARKW) added 29,837 shares of the e-commerce and cloud company.

ARK is one of the most closely watched funds in the market, and its trades typically have a bearing on investor sentiment.

The fund also bought $6.1 million worth of shares of Advanced Micro Devices (AMD) and $7.3 million worth of shares of Guardant Health (GH).

It sold $13 million worth of shares of CoreWeave (CRWV) and about $6 million of Palantir Technologies (PLTR) after a recent rally in both stocks.

CoreWeave has climbed 276% since its initial public offering in March, and Palantir currently trades at an all-time high, having been the one of the best-performing stocks with a 76% year-to-date gain.

ARK bought $9.3 million worth of Amazon shares in April when the stock was battered by the news of tariffs.

The increased exposure signals that investors are confident of Amazon's ability to navigate the macroeconomic headwinds while maintaining its growth.

Earlier this week, Bank of America raised its price target on Amazon stock to $248 from $230 while maintaining its 'Buy' rating.

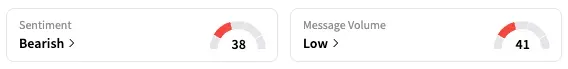

On Stocktwits, however, retail sentiment for Amazon was 'bearish,' unchanged from the previous week.

AMZN shares are down 6.2% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_dow_jones_jpg_e152f04aaa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264976085_jpg_5ac49235ee.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_newsmax_resized_jpg_3a813181b7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2192591876_jpg_b8c2306674.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_down_resized_901c19c371.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2218096416_jpg_9d469a2ec6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)