Advertisement|Remove ads.

CATL In Talks To Buy Controlling Stake In Nio’s Power Unit, Says Report: Retail Remains Sour On EV Maker

Shares of Nio Inc. (NIO) were in the spotlight on Monday morning after a media report said that Chinese battery giant CATL is in talks to buy a controlling stake in the EV maker’s power unit.

Reuters reported, citing four people familiar with the matter, that CATL is in talks to buy a controlling stake in Nio's power unit, which runs over 3,000 battery swapping stations in China.

The sources did not divulge how much CATL offered as part of the proposal. However, one of the sources told Reuters that Nio Power was valued at over RMB 10 billion ($1.37 billion) during a fundraising round in 2024.

Nio told Reuters that the company was promoting joint construction of battery swapping stations "with multiple investors, including CATL".

Last month, Nio said it has partnered with CATL to jointly build a battery swapping network for passenger vehicles.

The two companies will pursue capital cooperation as part of the partnership signed in Ningde, Fujian province, and CATL will invest up to RMB 2.5 billion in Nio Power, the company had said.

Nio offers battery swapping and charging options for its electric vehicles. A battery swap, Nio says, saves the driver time as it takes only three minutes.

In the first quarter (Q1) of 2025, Nio's deliveries rose 40% year over year to 42,094 vehicles, in line with its outlook of deliveries between 41,000 and 43,000 units, but below the 72,689 units delivered in the fourth quarter (Q4) of 2024.

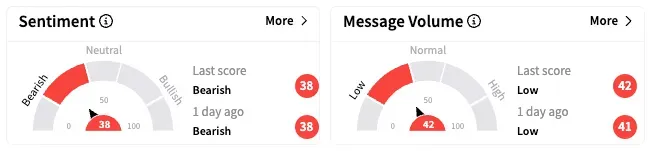

On Stocktwits, retail sentiment around Nio remained unmoved in the ‘bearish’ territory, coupled with ‘low’ message volume over the past 24 hours.

Nio also announced on Monday that it has completed its HK$4.03 billion ($0.52 billion) offering of 136.8 class A ordinary shares, announced in late March.

Nio shares are down by about 24% this year and by nearly 21% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Exchange Rate: 1 RMB = 0.14 USD

1 HKD = 0.13 USD

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)