Advertisement|Remove ads.

Cboe Pushes For Ether Staking In ETFs While Token Struggles Below $2K – Stock Drops Amid Market Slump

Cboe Global Markets Inc. (CBOE) has filed amended documents with the U.S. Securities and Exchange Commission (SEC), seeking approval to integrate staking into several spot Ether (ETH) exchange-traded funds (ETFs).

However, Ethereum’s price remains under pressure, trading below $2,000, while Cboe’s stock dipped 2.5% in midday trade on Tuesday amid the broader market slump.

Existing Ethereum ETFs are also facing headwinds. Investor withdrawals have totaled $130.4 million over four consecutive days, according to Farside data.

The Chicago-based exchange operator is associated with five major issuers of Ether ETFs, including Fidelity, Franklin Templeton, VanEck, and Invesco/Galaxy.

On Tuesday, it submitted amended 19b-4 filings for the Fidelity Ethereum Fund (FETH) and the Franklin Ethereum ETF (EZET), proposing to integrate staking into these funds.

If approved, this would allow the ETFs to participate in Ethereum’s proof-of-stake mechanism, enabling them to generate additional returns by validating transactions on the blockchain.

Staking involves locking Ether to help secure the network in exchange for rewards. For ETFs, it offers a potential yield beyond simple price appreciation.

However, the SEC had previously blocked staking when it first approved spot Ether ETFs in mid-2024, citing concerns over securities law violations.

In its filing, Cboe argues that staking would "improve the creation and redemption process for both authorized participants and the Trust, increase efficiency, and ultimately benefit the end investors in the Trust."

The proposed staking framework establishes clear guidelines, citing that only ETH held within the fund would be staked and that assets would not be pooled with external parties. It also highlighted that the fund's sponsor would not market staking services, guarantee returns, or solicit assets from third parties.

The SEC has 45 days to respond to Cboe’s filing. If approved, it could set a precedent for integrating staking into ETFs.

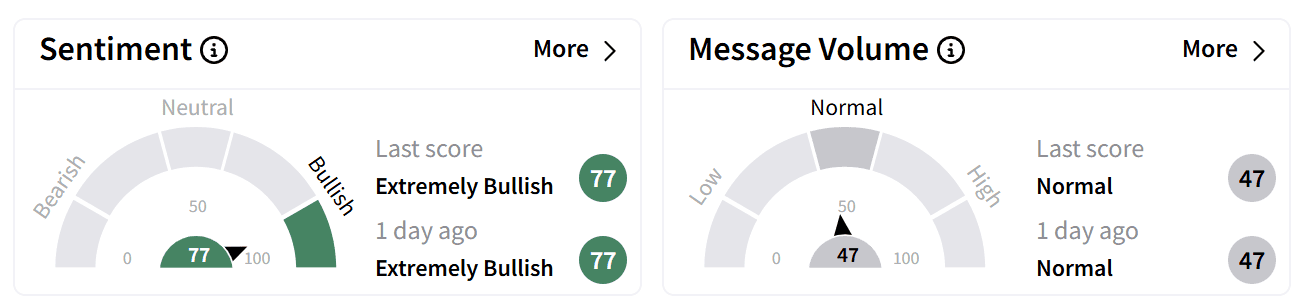

On Stocktwits, retail sentiment around Cboe’s stock remained in the ‘extremely bullish’ territory, despite the stock’s modest decline on Tuesday.

Its shares are up 8.5% this year, adding to its gains of over 14.5% over the past year.

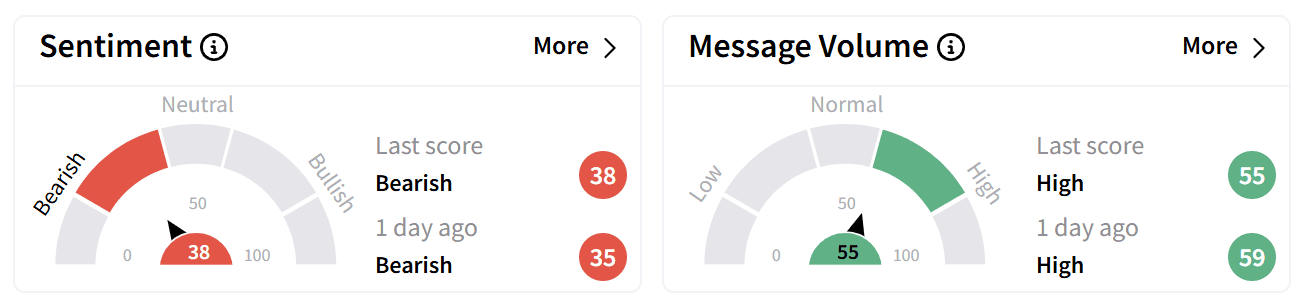

Meanwhile, retail sentiment around Ethereum’s token ticked marginally upward but remained in the ‘bearish’ zone amid ‘high’ levels of chatter.

Some traders expressed skepticism about Ethereum’s valuation, with one user stating that ETH remains “too expensive” even after dipping below $2,000.

Others compared the current downturn to Ethereum’s steep decline following its 2017 bull run.

Ethereum’s price has fallen 30% over the past month and is down more than 50% year-over-year.

Staking isn’t the only ETF development on the SEC’s radar. The regulator is reviewing applications for funds tied to other digital assets, including Solana (SOL) and XRP (XRP).

The SEC recently acknowledged Cboe’s filings for the first spot XRP ETF on behalf of Coinshares, Canary Capital, and WisdomTree.

Last week, Canary Capital filed for its own Sui (SUI) ETF, and Bitwise filed to launch an Aptos (APT) ETF.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read also: Ethereum Eyes A Comeback, But ETF Outflows And Market Uncertainty Keep Traders On Edge

/filters:format(webp)https://news.stocktwits-cdn.com/large_moonlake_jpg_376bc698df.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stock_chart_image_d3ebab70ec.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_vlad_tenev_robinhood_CEO_OG_jpg_bf3a4c4bee.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250993932_jpg_77e7b26c88.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Deere_resized_a913c16f0a.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_b2gold_jpg_2d344842dd.webp)