Advertisement|Remove ads.

Celanese Stock Gains After-Hours On Q1 Profit Beat; Company Sees No Direct Tariff Impact In Q2 — Retail Bulls Elated

Celanese (CE) stock rose 6.3% in extended trading on Monday after the specialty chemicals firm topped first-quarter profit estimates.

According to Koyfin data, the company reported adjusted earnings of $0.57 per share for the quarter ended March 31, while analysts expected it to post earnings of $0.39 per share.

Its net sales of $2.39 billion topped Wall Street’s estimates of $2.26 billion.

However, it reported a net loss of $17 million for the first quarter compared to a year-ago profit of $124 million.

Its Acetyl Chain segment's first-quarter net sales rose 1% sequentially to $1.1 billion, aided by a 3% increase in volume that was partially offset by a 1% price and currency decline.

The company said that, as in the prior quarter, demand continued to remain weak in the Western Hemisphere while paint, coating, and construction demand in Asia remained sluggish.

Engineered Materials reported first-quarter net sales rose 1% sequentially to $1.3 billion. The increase was due to a 1% increase in volume and price, partially offset by a 1% decline in currency.

The company noted that while the demand environment remains uncertain, it does not anticipate a direct tariff impact in the second quarter.

Celanese also expects a slight volume recovery in the automotive segment in the second quarter, with more stabilized demand, especially in the U.S. and China.

It projected that the second quarter's adjusted earnings would be between $1.30 and $1.50 per share.

“Still, the potential impacts of tariffs on demand make it difficult to predict earnings for the full year," Chief Financial Officer Scott Richardson said.

The company said it is also looking to divest its Micromax portfolio of products.

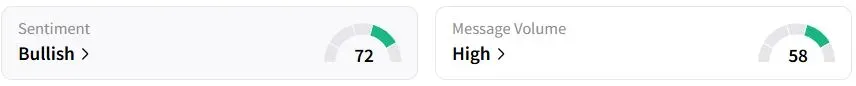

Retail sentiment on Stocktwits was in the ‘bullish’ (72/100) territory, while retail chatter was ‘high.’

One user hoped that the stock would hit $60 soon.

Celanese stock have fallen 35.6% year to date (YTD).

Also See: Air Lease Tops Q1 Profit Estimates, May Buy Boeing Aircraft Refused by China: Retail’s Bullish

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229273911_jpg_6b4851e2cc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_autozone_resized_jpg_8733836467.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_kashkari_original_jpg_b7db42a385.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_cigna_shares_resized_2250d1271f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250352860_jpg_45946f3f12.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/astspacemobile_resized_jpg_8a6aa92413.webp)