Advertisement|Remove ads.

Celestica Stock On Track To Hit Record Highs: What’s Powering The Rally?

- Celestica shares hit a fresh high in premarket trade on Tuesday

- Celestica’s Q3 net earnings surged threefold to $267.8 million, while revenue rose nearly 28% to $3.19 billion

- Celestica raises FY2025 revenue forecast to $12.2 billion from $11.55 billion

Shares of Celestica Inc. (CLS) hit a fresh high in premarket trade on Tuesday, climbing 11.6% to $336.75. The data center infrastructure provider posted a strong Q3 print after market hours on Monday and raised its full-year revenue and EPS outlook for 2025.

Robust Growth In CCS and HPS Segments

Celestica’s net earnings for the third quarter surged threefold to $267.8 million on a year-on-year (YoY) basis, while its revenue rose nearly 28% to $3.19 billion.

Revenue from Celestica’s Connectivity & Cloud Solutions (CCS) segment grew 43% to $2.41 billion, with margins improving to 8.3% from 7.6%. Hardware Platform Solutions revenue surged 79% to $1.4 billion. However, revenue from its Advanced Technology Solutions (ATS) segment declined 4% to $0.78 billion, though margin improved to 5.5% from 4.9%.

The company was bullish about its FY2025 outlook, raising its revenue projection to $12.2 billion from $11.55 billion and its adjusted EPS to $5.90, up from an earlier forecast of $5.50. For 2026, the company expects a revenue of $16 billion, an adjusted operating margin of 7.8%, and adjusted EPS of $8.20.

How Did Stocktwits Users React?

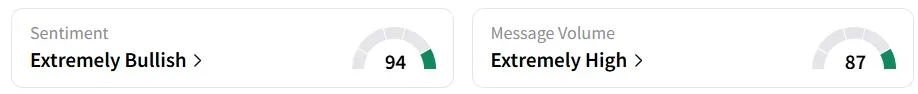

The positive print got chatter up on Stocktwits. Retail sentiment on the platform remained ‘extremely bullish’, amid ‘extremely high’ message volumes. It was ‘bullish’ last week.

One user said that the CCS segment’s performance has allowed the company to focus on higher-margin projects.

Celestica was among the top five most ‘bullish’ stocks on the platform.

The stock has seen strong buying interest so far this year, more than tripling in value.

Get updates to this developing story directly on Stocktwits.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Goldman_Sachs_resized_c6a47f630c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_cybertruck_jpg_7f6ed70b80.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Nebius_jpg_291bb409c7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2202349941_jpg_3f45878d03.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_marathon_holdings_resized_40790d98cc.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)