Advertisement|Remove ads.

Celsius Stock Holds Steady, But Retail Sentiment Drains On Wall Street Downgrade And Rival's Woes

Celsius Holdings Inc. (CELH) shares are clinging to modest gains around $39.69 on Thursday, despite headwinds from a Wall Street downgrade and disappointing results from competitor Monster Beverage (MNST). But the fear factors have dented retail investors’ confidence.

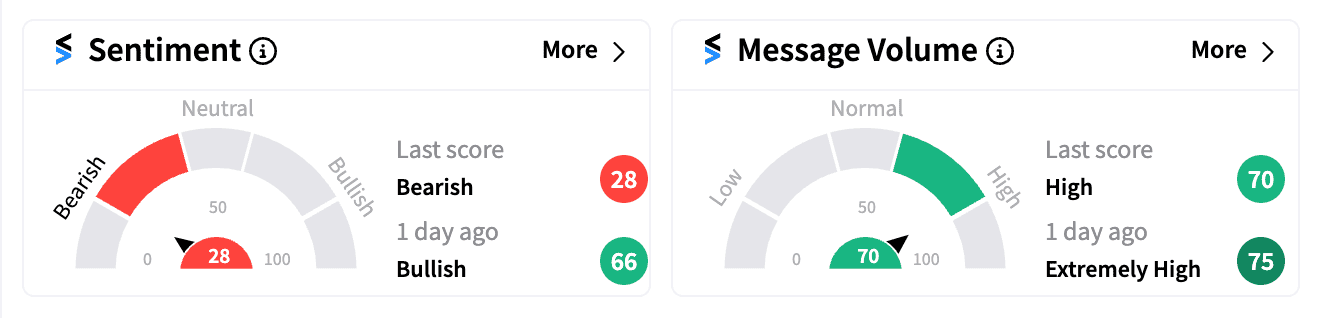

While Celsius initially enjoyed a 'bullish' reaction to its Q2 earnings exceeding expectations on Tuesday, Stocktwits data reveals a sharp reversal. Retail sentiment has plummeted from ‘bullish’ just a day ago to a current ‘bearish’ zone (28/100).

Despite maintaining ratings on Celsius stock, several brokerages trimmed price targets on Wednesday. A Seeking Alpha analysis highlighted CELH's slowing growth, market share loss, and uncertain future prospects.

Adding to the bearish sentiment was Monster Beverage's Wednesday earnings report, missing both sales and profit estimates. This, combined with their warnings of a "tight consumer environment," sparked concerns about declining demand for non-essential beverages like energy drinks amid sticky inflation.

On Thursday, Bank of America took a more aggressive stance, downgrading Celsius from ‘Neutral’ to ‘Underperform’ and slashing its price target to $32 – a 19% drop from current levels.

Analyst Jonathan Keypour expressed concerns about Celsius' demographic dependence and vulnerability to a category-wide slowdown, potentially threatening its market share gains.

"With U.S. distribution completed via the Pepsi partnership, CELH will need to source growth from shelf expansion despite flagging velocity and mounting competition," he noted.

While acknowledging Celsius' sales and EBITDA potential, BofA remains cautious, waiting for evidence of renewed momentum and market share gains.

Despite today's slight rebound, Celsius stock continues to trade at 15-month lows, remaining down over 32% year-to-date. These facts haven't escaped the attention of the now-bearish retail investors.

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_atm_original_jpg_afc73e9be7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262712431_1_jpg_6f471d2542.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_jpg_4ad189441e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259503553_jpg_13fb8f2e88.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_trader_stock_chart_resized_861d098b1f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)