Advertisement|Remove ads.

Cenovus Energy Stock Rises After Beating Q1 Estimates, Retail’s Divided

U.S. shares of Cenovus Energy rose more than 8% on Thursday after it topped first-quarter profit expectations.

Reuters reported, citing LSEG data, that the company reported quarterly profit per share of 47 Canadian cents, while analysts expected to post 37 cents per share.

However, the company’s first-quarter net income fell to C$859 million ($618.79 million) from C$1.18 billion in the year-ago quarter.

Cenovus' total upstream production rose to 818,900 barrels of oil equivalent per day (boepd) in the reported quarter from 800,900 boepd a year earlier.

The company attributed the rise in production to optimization programs, new sustaining well pads at its Foster Creek project, and strong performance at its Terra Nova field.

The company’s total refining production volumes rose 3% to 722,400 barrels per day.

Its crude unit utilization was 104% compared to 96% a year earlier.

The company said its Toledo refinery is undergoing a major turnaround, including maintenance on eight units within the refinery.

"We expect to see a clear runway for our U.S. refining business to deliver higher performance through the second half of the year," CEO Jon McKenzie said in a call with analysts.

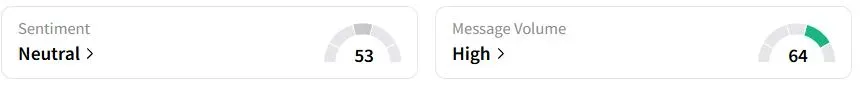

Retail sentiment on Stocktwits was in the ‘neutral’ (53/100) territory, while retail chatter was ‘high.’

Cenovus stock has fallen 16.7% year-to-date (YTD), tracking a decline in crude oil prices due to recession worries and oversupply concerns.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)