Advertisement|Remove ads.

MP Materials Retail Traders Stay Bearish After Q1 Loss, CEO Looks To Cut Reliance On Chinese Rare-Earth Processing

MP Materials (MP) stock was in the spotlight on Friday after the company posted a net loss amid a rise in sales costs.

The rare-earth mining firm reported a net loss of $22.6 million for the three months ended March 31, compared to a profit of $16.49 million in the year-ago quarter.

It reported an adjusted per-share loss of $0.12, which was in line with estimates compiled by LSEG, according to a Reuters report.

Its earnings were impacted by higher cost of sales and higher interest paid on convertible debt.

The company’s total revenue rose 25% to $60.8 million year over year, primarily due to higher production of separated products. This compares to Wall Street’s expectations of $61.8 million, according to FinChat data.

MP produced 563 metric tons of neodymium and praseodymium (NdPr) at its California refinery to hit a new output record.

The company said its NdPr sales volumes more than doubled year-over-year to 464 metric tons.

“Given recent events, it is now undeniable that the United States must reshore critical industries like rare earth magnetics — something we have been building toward since day one,” CEO James Litinsky said.

In April, the company decided to stop rare earth shipments for refining in China due to Beijing's 125% retaliatory tariffs on U.S. imports. The decision's impact will be visible later in the year.

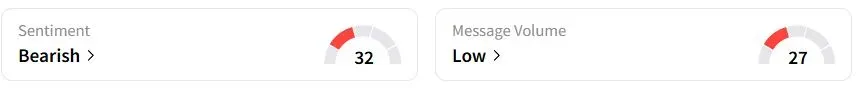

Retail sentiment on Stocktwits was in the ‘bearish’ (27/100) territory, while retail chatter remained ‘low.’

One user said the stock is derisked totally with no demand issues and “lots of buyers” lining up.

Another user was pleased to hear about the talks between the U.S. government and the company.

“We are now in active discussions with major commercial and government stakeholders who recognize the urgency of this moment,” Litinsky said in a call with analysts.

MP Materials stock has jumped 50.5% year to date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Rocketlab_resized_jpg_92c1a02a7f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2201668075_jpg_cae68c6d02.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2197860201_jpg_c4f2083335.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250993932_jpg_77e7b26c88.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Block_Inc_logo_displayed_on_smartphone_screen_6065fd32bb.webp)