Advertisement|Remove ads.

Centene Shares Drop On Stock Downgrade, Price Target Cuts Over Withdrawn 2025 Guidance

Shares of Centene Corp (CNC) traded 40% lower on Wednesday after several brokerages lowered their price target on the stock on the heels of the health insurer withdrawing its 2025 financial guidance.

The company withdrew its 2025 earnings guidance on Tuesday due to an expected fall in revenue under plans associated with the Affordable Care Act, or Obamacare.

It said that data from 22 states offering plans under Obamacare point towards a $1.8 billion reduction in the company's risk adjustment revenue, corresponding to an adjusted diluted earnings per share (EPS) impact of approximately $2.75.

While Centene doesn’t have information for the remaining seven states that offer Obamacare plans, Centene said that it anticipates additional reductions to its net risk adjustment revenue owing to the trend observed in the 22 other states.

The company also disclosed a rise in medical cost trends within its Medicaid business, particularly in behavioral health, home health, and high-cost drugs. It said that these dynamics were more pronounced in certain geographies like New York and Florida, and added that it expects second-quarter (Q2) 2025 medical costs to be higher than in the first quarter (Q1).

Following the update, several analysts rushed to downgrade the stock, as per TheFly.

- UBS analyst AJ Rice downgraded Centene to ‘Neutral’ from ‘Buy’ with a price target of $45, down from $80.

- JPMorgan downgraded Centene to ‘Neutral’ from ‘Overweight’ with a price target of $48, down from $75.

- Cantor Fitzgerald analyst Sarah James lowered the firm's price target on Centene to $65 from $90 and kept an ‘Overweight’ rating on the shares.

- Barclays lowered the firm's price target on Centene to $45 from $65 and kept an ‘Equal Weight’ rating on the shares.

- Bank of America analyst Joanna Gajuk lowered the firm's price target on Centene to $52 from $65 and kept a ‘Neutral’ rating on the shares.

Other MCOs at Risk?

JPMorgan, however, believes that it is "too early to conclude" that other Managed Care Organizations (MCOs) are exposed to a similar risk as Centene and said it is "apprehensive about extrapolating" Centene's challenges to the broader MCO group with smaller exposures across the group.

BofA, however, opined that the concerns flagged by Centene while withdrawing its guidance may have an impact on other MCOs as well. The firm noted that Oscar Health (OSCR), Centene, and Molina Healthcare (MOH) are the most exposed to Obamacare, while Molina, Elevance Health (ELV), and UnitedHealth (UNH) are most exposed to Medicaid.

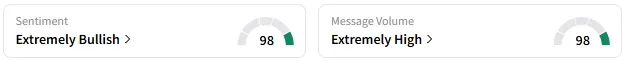

Retail sentiment around Centene on Stocktwits jumped from ‘neutral’ to ‘extremely bullish’ territory over the past 24 hours while message volume rose from ‘normal’ to ‘extremely high’ levels.

The stock is down by 43% this year and by about 48% over the past 12 months.

Read Next: Regeneron’s Therapy For Blood Cancer Bags FDA Approval: REGN Stock Jumps

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Circle_Internet_jpg_add0182c9c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1227710498_jpg_fbb12d04bf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)