Advertisement|Remove ads.

NBFCs to see 18-19% growth but watch for LAP risks, say Crisil's Krishna Sitaraman and Piramal's Jairam Sridharan

Jairam Sridharan, MD & CEO of Piramal Finance and Krishnan Sitaraman, Chief Ratings Officer at Crisil Ratings discuss NBFC sector growth, rising LAP risks, funding pressures, and the outlook for margins and asset quality.

The non-banking financial company (NBFC) sector is poised for robust growth, with rating agency Crisil projecting an 18-19% increase in assets under management (AUM) for the current and next fiscal year. However, experts caution that this optimistic outlook is accompanied by emerging asset quality concerns, particularly in the loan against property (LAP) segment.

In a discussion, Krishna Sitaraman, Chief Ratings Officer of Crisil, and Jairam Sridharan, Managing Director and Chief Executive Officer of Piramal Finance, shared their insights on the sector's trajectory. Sitaraman, whose agency authored the optimistic report, stated that the projected 18-19% growth is a significant step up from the sector's decadal average of 14%. "The first half of this fiscal year has seen some slowdown in the growth as bank lending became a little more cautious.

However, the policy measures that the government has announced, the goods and services tax (GST) rationalisation, the lower interest rate regime, benign inflation and the income tax cuts… and also the healthy monsoons, have revised our estimates on the growth slightly upwards," Sitaraman explained. He believes these factors will drive consumption and retail credit, with growth led by secured asset classes like LAP and gold loans.

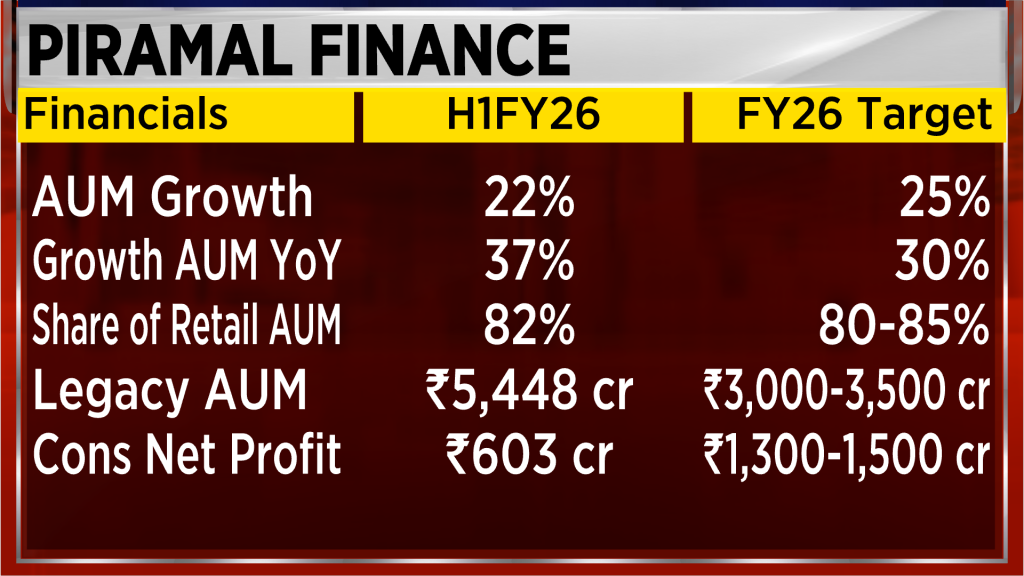

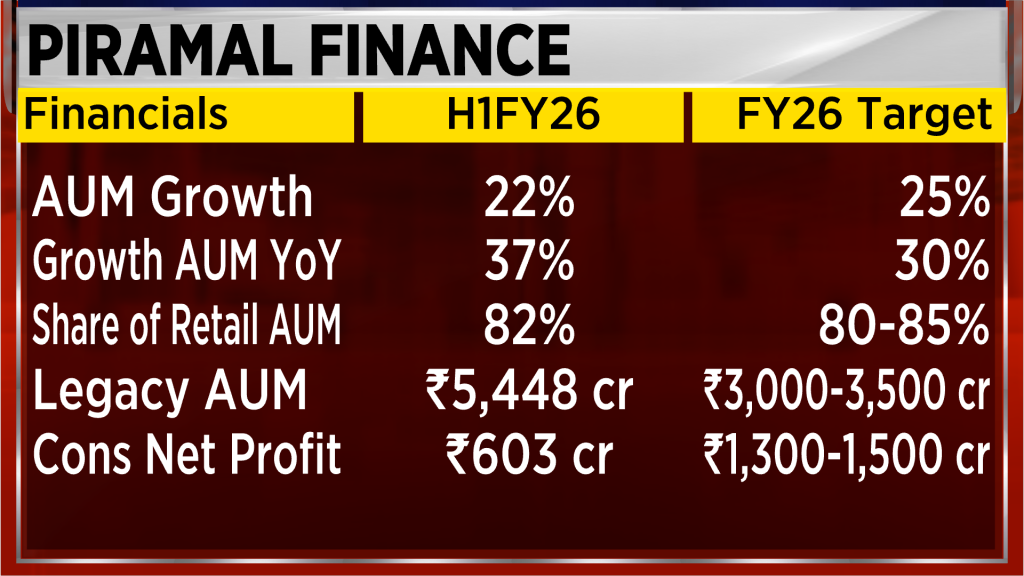

Jairam Sridharan of Piramal Finance confirmed the strong momentum, revealing that his company's performance has outpaced the industry. He described the recent festive season as the "biggest… in a very, very long time," during which Piramal's disbursement growth hit 45% year-on-year. While this has moderated to a still-strong 24% in the post-festive period, he projects an overall AUM growth of around 26% for Piramal Finance. "It has been a very good start to the October-December 2025 (Q3FY26) for the NBFC sector overall… as Sitaraman pointed out, it's led by the secured segments. LAP is doing extraordinarily well," Sridharan added.

Also Read: Credit growth picking up; banks better placed than NBFCs, says JM Financial's Ajit Kumar

Despite the strong growth, both experts flagged potential risks to asset quality. Sitaraman stated that while a major cause for concern is not present, a marginal uptick in delinquencies is expected across the board. He specifically pointed to the unsecured segment, including microfinance and unsecured personal loans, where delinquencies have risen over the past year. "One of the key reasons that we have identified is customer over-leveraging and that has caused problems in the repayment ability," Sitaraman said. He also highlighted small-ticket business loans, largely comprising LAP, as another area showing a recent uptick in delinquencies.

Sridharan echoed these concerns, identifying the LAP segment as his "emerging pocket of concern." He warned that risks could be spilling over into smaller-ticket LAP, which already seems impacted. "My anxiety building up right now is just to make sure that the LAP business, which looks so great right now—fantastic growth, great margins, superb risk, everything looks good about that segment—I wonder whether it is too good to be true and whether something is going to give there," he remarked.

Also Read: NBFCs push for reforms ahead of Budget 2026, FIDC seeks dedicated refinance window

On the topic of funding, Sitaraman pointed to a clear divergence in the sector. "We are seeing the AAA and the AA-rated NBFCs grow faster than the B and the single A-rated NBFCs," he said. This is largely due to access to funding, as bank lending to the sector has slowed considerably. Larger NBFCs can tap debt capital markets and external commercial borrowings (ECBs), while smaller players struggle.

However, Sridharan expressed optimism about funding costs and margins for established players. He anticipates that the cost of funds for NBFCs is headed down, potentially leading to margin expansion for the sector, in contrast to banks, which may see margin compression. "There is about a one-year lag between when RBI was increasing [rates] and when it was reflecting in NBFC P&Ls. The same will happen on the way down," he predicted. For Piramal, he expects the cost of borrowing to fall by another 25 basis points this fiscal year, potentially pushing their net interest margins (NIMs) into double-digit territory.

For the entire discussion, watch the accompanying video

Catch all the latest updates from the stock market here

In a discussion, Krishna Sitaraman, Chief Ratings Officer of Crisil, and Jairam Sridharan, Managing Director and Chief Executive Officer of Piramal Finance, shared their insights on the sector's trajectory. Sitaraman, whose agency authored the optimistic report, stated that the projected 18-19% growth is a significant step up from the sector's decadal average of 14%. "The first half of this fiscal year has seen some slowdown in the growth as bank lending became a little more cautious.

However, the policy measures that the government has announced, the goods and services tax (GST) rationalisation, the lower interest rate regime, benign inflation and the income tax cuts… and also the healthy monsoons, have revised our estimates on the growth slightly upwards," Sitaraman explained. He believes these factors will drive consumption and retail credit, with growth led by secured asset classes like LAP and gold loans.

Jairam Sridharan of Piramal Finance confirmed the strong momentum, revealing that his company's performance has outpaced the industry. He described the recent festive season as the "biggest… in a very, very long time," during which Piramal's disbursement growth hit 45% year-on-year. While this has moderated to a still-strong 24% in the post-festive period, he projects an overall AUM growth of around 26% for Piramal Finance. "It has been a very good start to the October-December 2025 (Q3FY26) for the NBFC sector overall… as Sitaraman pointed out, it's led by the secured segments. LAP is doing extraordinarily well," Sridharan added.

Also Read: Credit growth picking up; banks better placed than NBFCs, says JM Financial's Ajit Kumar

Despite the strong growth, both experts flagged potential risks to asset quality. Sitaraman stated that while a major cause for concern is not present, a marginal uptick in delinquencies is expected across the board. He specifically pointed to the unsecured segment, including microfinance and unsecured personal loans, where delinquencies have risen over the past year. "One of the key reasons that we have identified is customer over-leveraging and that has caused problems in the repayment ability," Sitaraman said. He also highlighted small-ticket business loans, largely comprising LAP, as another area showing a recent uptick in delinquencies.

Sridharan echoed these concerns, identifying the LAP segment as his "emerging pocket of concern." He warned that risks could be spilling over into smaller-ticket LAP, which already seems impacted. "My anxiety building up right now is just to make sure that the LAP business, which looks so great right now—fantastic growth, great margins, superb risk, everything looks good about that segment—I wonder whether it is too good to be true and whether something is going to give there," he remarked.

Also Read: NBFCs push for reforms ahead of Budget 2026, FIDC seeks dedicated refinance window

On the topic of funding, Sitaraman pointed to a clear divergence in the sector. "We are seeing the AAA and the AA-rated NBFCs grow faster than the B and the single A-rated NBFCs," he said. This is largely due to access to funding, as bank lending to the sector has slowed considerably. Larger NBFCs can tap debt capital markets and external commercial borrowings (ECBs), while smaller players struggle.

However, Sridharan expressed optimism about funding costs and margins for established players. He anticipates that the cost of funds for NBFCs is headed down, potentially leading to margin expansion for the sector, in contrast to banks, which may see margin compression. "There is about a one-year lag between when RBI was increasing [rates] and when it was reflecting in NBFC P&Ls. The same will happen on the way down," he predicted. For Piramal, he expects the cost of borrowing to fall by another 25 basis points this fiscal year, potentially pushing their net interest margins (NIMs) into double-digit territory.

For the entire discussion, watch the accompanying video

Catch all the latest updates from the stock market here

Read about our editorial guidelines and ethics policy

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_weride_stock_resized_710a92d4f7.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2203138957_jpg_dd735f9905.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Diginex_resized_jpg_276540aa7c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://images.cnbctv18.com/uploads/2023/11/novo-nordisk.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/cnbctv18logo.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2192293006_jpg_2bd8d914f8.webp)

/filters:format(webp)https://images.cnbctv18.com/uploads/2024/12/substation-2024-12-0621171b5ed70463435b0fccaaaf33da.jpeg)