Advertisement|Remove ads.

CG Power Shares: SEBI RA Deepak Pal Sees Scope For Breakout Above ₹700

CG Power & Industrial Solutions, a part of the Murugappa Group, is on the analyst’s radar, driven by its technical charts. The company had also launched a ₹3,000 crore qualified institutions placement (QIP) of equity shares with a face value of ₹2 each this week. Reports indicate that the QIP garnered approximately Rs 10,000 crore in bids.

On the technical charts, SEBI-registered analyst Deepak Pal noted that the stock has continued to trade in a positive trend and has been holding above its 14-day Exponential Moving Average (EMA) until earlier this week. On the weekly chart, CG Power stock is comfortably holding above its 14-day EMA, with the ₹641 level acting as a strong support zone around the 55-day EMA.

Technical indicators, such as the Moving Average Convergence Divergence (MACD) and the Relative Strength Index (RSI), reflected positive momentum, suggesting the stock is poised for a potential pullback rally.

Pal believes that any dip towards ₹650–660 could provide a favourable entry opportunity, with ₹625 acting as a strong stop-loss for holding positions. On the upside, the stock has the potential to retest and possibly surpass the ₹700 mark in the near term.

Fundamentally, the company has a near-debt-free balance sheet, which provides financial flexibility. Margins have steadily improved, driven by operational discipline, premium product mix, and strategic pricing. Also, their order book hit an all-time high of over ₹9,500 crore as of March 2024.

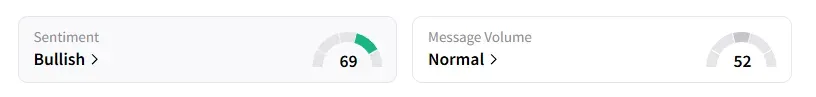

Data on Stocktwits shows that retail sentiment has been ‘bullish’ on this counter for a week.

CG Power shares have fallen 8% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2218096416_jpg_9d469a2ec6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229019640_jpg_c6006d7238.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)