Advertisement|Remove ads.

Chevron, Phillips 66, TotalEnergies Partner With Indian Refiners To Supply LPG From 2026: Report

- India aims to source roughly 10% of its cooking gas imports from the U.S. starting in 2026.

- The deal will help address India’s substantial trade deficit with the U.S.

- Wells Fargo raised Chevron’s price target to $196 from $190.

Indian state refiners have awarded their first joint long-term contracts to Chevron Corp. (CVX), Phillips 66 (PSX), and TotalEnergies Trading to buy U.S. liquefied petroleum gas (LPG) in 2026, Reuters reported on Friday.

The three refiners were collectively seeking around 48 very large gas carriers, or roughly 2 million metric tons of LPG, for delivery in 2026.

The tenders also gave suppliers the flexibility to deliver LPG from any origin for one out of every four cargoes. Specifics on cargo allocations and pricing were not disclosed.

According to reports, India aims to source roughly 10% of its cooking gas imports from the U.S. starting in 2026.

LPG, a mixture of propane and butane widely used as a household cooking fuel, is primarily imported by Indian Oil, Bharat Petroleum, and Hindustan Petroleum, and sold domestically at subsidized rates.

Key Factor In U.S.–India Trade

Energy has been the sticking point in the topsy-turvy trade partnership between the two countries this year. In August, U.S. President Donald Trump imposed a 50% tariff on Indian exports, blaming the country for funding the Ukraine-Russia war by buying the deeply discounted Russian crude.

The latest partnership aligns with India’s strategy to diversify into U.S. energy, which is also expected to address its substantial trade deficit, which reportedly surpassed $41 billion last year.

In September, Commerce and Industry Minister Piyush Goyal said that India is a major energy importer and anticipates increasing energy trade with the U.S. in the coming years.

U.S. Energy Secretary Chris Wright had also voiced support for deeper energy collaboration, including natural gas, coal, nuclear, and clean technologies, describing India as an “awesome ally” with rising energy demands.

How Did Stocktwits Users React?

Earlier on Friday, Wells Fargo analyst Sam Margolin raised Chevron’s price target to $196 from $190 and kept an ‘Overweight’ rating, according to TheFly.

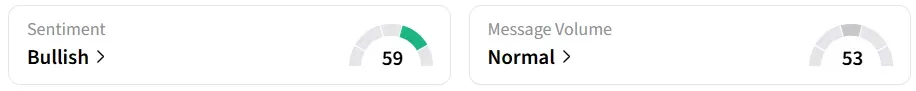

The shares were up 0.5% at $156.37 on Friday, while retail sentiment on Stocktwits turned ‘bullish’ from ‘bearish’ in the last 24 hours. CVX stock has gained around 7.5% so far this year.

Phillips 66 shares were up 1.9% at $142.16, having gained 24% year-to-date.

Also See: Standard Lithium Gets Major US Government Backing In Race With Exxon To Mine Lithium In Arkansas

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2071907975_jpg_85e059f13e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2219301415_jpg_7634ca599c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2203138957_jpg_dd735f9905.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228736233_jpg_f3ebe80a4c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Stock_market_Image_public_domain_declining_wc_96197f57d2.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2236469013_jpg_0a72164947.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)