Advertisement|Remove ads.

Chevron Stock In Spotlight As Oil Major Plans To Lay Off Up To 20% Workforce: Retail’s Bearish

Chevron (CVX) stock drew retail attention on Thursday after the company said it would lay off between 15% and 20% of its workforce.

The workforce reduction would begin in 2025 and is likely to complete before the end of 2026.

“These reductions are in line with our previous announcement of $2 to $3 billion in targeted structural cost reductions by the end of 2026, with some residual impact in 2027 and beyond,” a company spokesperson said.

Chevron said it would help its employees through the transition, and the steps were taken to improve the company's long-term competitiveness.

On Dec. 31, 2023, the company had about 40,000 employees, excluding its more than 5,000 service station workers.

According to a Reuters report citing a source, the company told employees during an internal town hall meeting that they could begin opting for buyouts through April or May.

Chevron’s oil reserves have receded to their lowest point, at least in a decade. However, the company has been able to ramp up production in the Permian basin and has started an expansion project in Kazakhstan’s Tengiz oilfield.

Chevron, which agreed to buy Hess Corp for $53 billion, aims to replenish its reserves from Guyana, where more than 11 billion barrels of oil have been discovered so far.

However, the company has not been able to close the deal as it remains locked in an arbitration dispute with rival Exxon over Hess’s Guyana assets. A tribunal is expected to hear the case later this year.

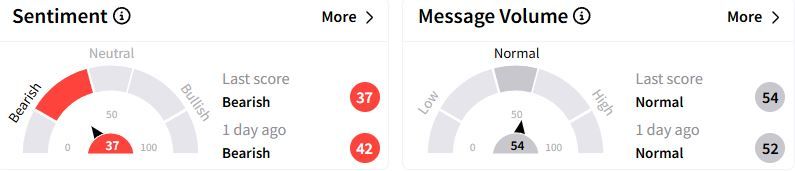

Retail sentiment on Stocktwits remained in the ‘bearish’ (37/100) territory, albeit with a lower score than a day ago, while retail chatter was ‘normal.’

Over the past year, Chevron stock has gained about 1.3% compared with a nearly 5% rise in Exxon’s shares.

Chevron had missed Wall Street’s fourth-quarter earnings estimates in January, and its downstream unit posted a loss for the first time since the pandemic.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_Social_logo_1200_Px_resized_jpg_86883cac04.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2243387433_jpg_9712a99e81.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227049575_jpg_fe5b82901f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228864541_jpg_d94770c5a8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_AI_OG_jpg_872671f607.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)