Advertisement|Remove ads.

Chewy Shareholder BC Partners To Sell $1B Shares: Retail Mood Drops

Funds advised by BC Partners, Chewy's (CHWY) largest shareholder, are selling $1 billion worth of shares, the pet supplies company said on Monday. The company's stock dropped 2.3% in after-market trading after the company revealed the block trade in an exchange filing.

Large sales are typically bad for a stock, as they signal that the selling investor sees little upside.

BC Partners funds are selling 23.9 million Class A shares of Chewy at $41.91 per share, according to an exchange filing.

Chewy won't receive any proceeds from the sale but has agreed to buy from the BC Partners funds $100 million worth of shares to be canceled upon completion of the deal.

Chewy said the buyback was unrelated to its existing $500 million repurchase program, which remains untouched.

The sale would reduce BC Partners' economic interest in Chewy to about 47% from about 53%, according to Bloomberg calculations.

The investor will be restricted from selling any additional shares of Chewy for 60 days, according to the filing.

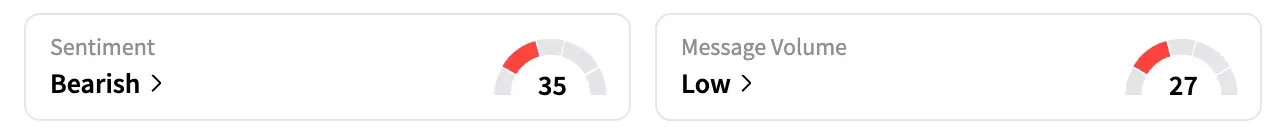

Retail investors grew cautious. On Stocktwits, the sentiment dropped to 'bearish' as of early Tuesday from 'extremely bullish' a week ago.

A user said the $1 billion stock sale might create "enormous selling pressure" for the stock.

However, another noted that "Chewy isn't diluting shares, it's not raising emergency cash, and the company itself is repurchasing shares, not dumping them."

On the business side, Chewy has demonstrated strong financial performance in the last few quarters, indicating business momentum. Its shares hit an over two-year high earlier this month and are up nearly 30% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2219301415_jpg_7634ca599c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2203138957_jpg_dd735f9905.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228736233_jpg_f3ebe80a4c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Stock_market_Image_public_domain_declining_wc_96197f57d2.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2236469013_jpg_0a72164947.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2244672917_jpg_95b721e1af.webp)