Advertisement. Remove ads.

How Are Retail Investors Treating Chipotle, AT&T, Ford, IBM, And Quantumscape Ahead Of Earnings

A host of big Wall Street names from diverse sectors like restaurant operations, telecom, tech, and auto are scheduled to announce their quarterly earnings on Wednesday. Retail investors are bullish on a few of these names but are maintaining a fair degree of skepticism for the others. Let’s find out in detail.

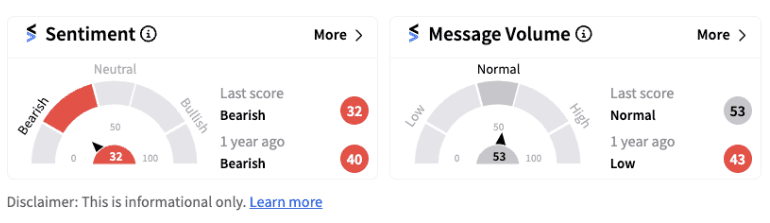

1. Chipotle Mexican Grill, Inc: Analysts are expecting the restaurant chain to report an upbeat set of second quarter earnings on Wednesday. Revenue is expected to come in at $2.94 billion as compared to $2.53 billion in the same period last year, according to an estimate. Diluted earnings per share (EPS) is expected to hit $0.31 as compared to $0.25 in Q2 of 2023. However, shares of the firm fell over 1% on Tuesday and retail investors’ mood is in sync with the fall. The sentiment meter is currently trending in the bearish territory (31/100). As of 1:10 p.m. EST, the stock is trying to find a support near its 200-DMA at $52.

2. AT&T Inc: The telecommunications major is expected to report EPS of $0.57 during the second quarter while revenues are expected to come in at $30 billion. The firm had recently acknowledged that call and text records of 109 million customers were compromised. However, the incident has hardly created any dent in retail sentiment for the stock which is currently trending in a bullish zone (55/100).

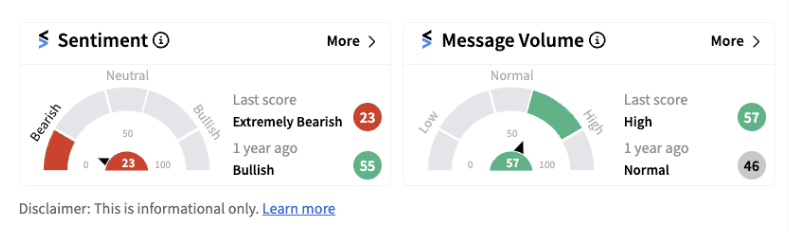

3. Ford Motor Co: The auto major is expected to report EPS of $0.68 during the second quarter. Operating profit is expected to come in at $3.70 billion while revenue is expected at $43.76 billion according to Street estimates. Retail investors, however, are maintaining caution ahead of the earnings given that the high interest rate environment isn’t too conducive for auto firms. The sentiment meter is trending in an extremely bearish zone (23/100) supported by high message volumes.

4. IBM: The tech major is expected to post second quarter EPS at $2.18 while revenue is expected to come in at $15.58 billion, which is slightly higher than what the firm posted in the same period a year ago. Retail investor sentiment is currently trending in bullish territory (62/100) for the stock. Recently, Evercore ISI reportedly added the stock to its “Tactical Outperform” list. The stock bounced from its 200-DMA twice — once in May and once in June, forming a double bottom pattern.

5. Quantumscape Corp: The firm that develops solid state lithium metal batteries for electric vehicles is expected to post a negative EPS of $0.23. Recently, the firm was in the news after it entered into an agreement with Volkswagen Group’s battery company PowerCo to industrialize its next-generation solid-state lithium-metal battery technology. The stock has gained over 60% in the past month. Ahead of its earnings, retail investors are optimistic on the stock with the sentiment meter trending in bullish territory (56/100).

Photo Courtesy: Carson Masterson on Unsplash

/filters:format(webp)https://news.stocktwits-cdn.com/large_hasbro_OG_jpg_4dd074e151.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_worldcoin_orb_OG_jpg_6c9401c649.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_OG_jpg_33767c6232.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2233715487_jpg_d8c0f3abb7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_elon_musk_jpg_80fa2e9cda.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2231040292_jpg_098a089ec8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)