Advertisement|Remove ads.

Chipotle Cuts Annual Same-Store Sales View On Uneven Demand, Tariff Hit: Retail Remains Optimistic

Chipotle Mexican Grill (CMG) on Wednesday reported weak first-quarter sales and lowered its expectations for this year, citing higher costs from tariffs and sluggish consumer spending.

The taco and burrito chain's comparable store sales fell 0.4%, the first time since 2020, below the 1.4% rise analysts had expected.

Quarterly revenue of $2.8 billion also missed the $2.9 billion analyst estimate from FactSet.

"In February, we began to see that elevated level of uncertainty felt by consumers. Consumers were saving money because of concerns around the economy, and reducing restaurant visits," CEO Scott Boatwright said on a post-earnings call.

"These trends continued into April."

Shares fell 2% in after-hours trading, following the results.

Chipotle said that new tariffs might raise its cost of sales by about 0.5% this year, which could translate to tens of millions of dollars in extra spending.

The projected increase stems from broad 10% tariffs on key imports, such as Australian beef and avocados from Colombia and Peru, as well as aluminum and packaging materials from countries including Vietnam and Indonesia.

The company now expects annual comparable sales growth in the low single-digit range, compared with a prior forecast for a low- to mid-single-digit rise.

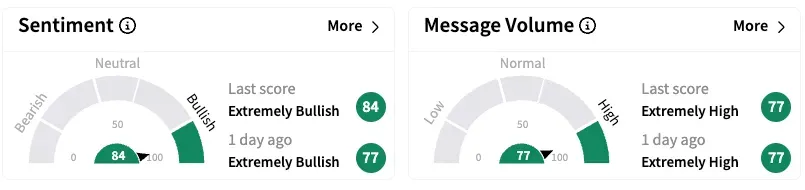

On Stocktwits, retail sentiment for CMG climbed higher in the 'extremely bullish' territory, and message volume jumped 468% from the previous day.

Several user posts suggested that the modest share drop, following the earnings, is a sign of confidence among investors and that the stock will rise.

Chipotle shares are down 19% year to date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2252956558_jpg_2dc0e5e537.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Git_Lab_resized_49b70b74d0.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_moderna_covid_jpg_3eb7363e71.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_crowdstrike_resized_jpg_6549f7641a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2234227546_jpg_b7fa546ca4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_digitalpayments_resized_png_5e564e753b.webp)