Advertisement|Remove ads.

Churchill Capital Stock Rallies After Citron Says Infleqtion Is ‘No Longer A Science Project’ Like Rigetti

- Citron said earlier that Infleqtion already sells deployable quantum systems and sensors.

- Infleqtion plans to go public through a merger with Churchill Capital.

- The company reported revenue, government customers and a growing order pipeline.

Shares of Churchill Capital Corp. (CCCX) were on track for their best session in nearly two months on Monday after Citron Research said Infleqtion, the quantum technology firm set to merge with the SPAC, was moving beyond the experimental stage.

At the time of writing, CCCX stock rose 14.6% to $15.87.

In a post on X, Citron said Infleqtion was “no longer a science project,” calling the business “real,” and contrasted it with Rigetti Computing, adding it expects the two companies’ market capitalizations to cross by early 2026.

Infleqtion SPAC Deal

Infleqtion is slated to go public through a merger with Churchill Capital, a blank-check company founded by financier Michael Klein. The company develops a range of quantum technologies spanning sensing, timing and computing, positioning itself as a broader quantum infrastructure provider rather than a pure-play quantum computing firm.

In a November Stocktwits interview, Infleqtion CEO Matt Kinsella said skepticism around quantum has largely been driven by repeatedly delayed timelines for large-scale quantum computing.

He said Infleqtion is focused on commercially viable products already in use, including quantum clocks and sensors, and noted that more than half of the company’s revenue comes from U.S. government customers.

Last week, Infleqtion announced a strategic collaboration with Safran Electronics & Defense to accelerate the development and deployment of next-generation precision timing systems for defense, aerospace and telecommunications markets.

Citron Points To Real-World Deployments

Citron has previously argued that Infleqtion is undervalued relative to peers, saying the company already sells deployable quantum hardware, sensors and atomic clocks, unlike rivals that remain earlier in development. In October, Citron said Infleqtion has real-world defense and aerospace deployments, including work tied to DARPA and the U.S. Air Force Research Laboratory.

In announcing the SPAC deal, Churchill Capital said Infleqtion counts customers such as Nvidia, the U.S. Department of Defense and NASA.

The company said Infleqtion has sold three quantum computers and hundreds of quantum sensors, generating about $29 million in trailing twelve-month revenue as of June 30, 2025. It also said Infleqtion expects roughly $50 million of booked and awarded business by the end of 2025 and has identified a potential customer pipeline exceeding $300 million.

Rigetti Pushes Toward Larger Quantum Systems

Rigetti is one of several companies advancing quantum computing technologies aimed at solving complex problems in areas such as cryptography, drug discovery and financial modeling.

The company said in late September it secured about $5.7 million in purchase orders for two 9-qubit Novera quantum systems, with deliveries targeted for the first half of 2026. Earlier in September, Rigetti also won a $5.8 million contract from the U.S. Air Force Research Laboratory to lead work on superconducting quantum networking.

How Did Stocktwits Users React?

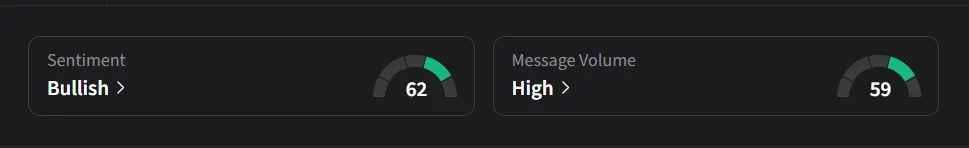

On Stocktwits, retail sentiment for Churchill was ‘bullish’ amid ‘high’ message volume.

One user said, “Citron still pounding the table“

Another user said, “when this becomes Infleqtion it goes nuts!”

Churchill’s stock has risen 55% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)