Advertisement|Remove ads.

Citi Lowers Price Target On This Chinese EV Maker After Disappointing Q3 Guidance: Retail Expects Shares To ‘Eventually Implode’

Citi on Friday lowered its price target on Chinese EV maker Li Auto (LI) to $25.60 from $33.90 while keeping a ‘Neutral’ rating on the shares.

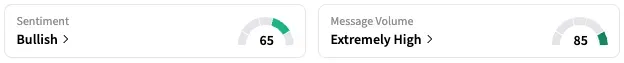

The new price target still represents a 10% upside to the stock’s closing price on Thursday. Citi cut estimates to reflect Li's third-quarter (Q3) outlook missing expectations, as per TheFly. On Stocktwits, retail sentiment around Li stock jumped from ‘Neutral’ to ‘Bullish’ territory over the past 24 hours, while message volume stayed at ‘extremely high’ levels.

A Stocktwits user stated that they expect the shares ‘to eventually implode.’

On Thursday, Li Auto stated that it expects third-quarter (Q3) vehicle deliveries to be between 90,000 and 95,000 vehicles, representing a year-over-year decrease of 41.1% to 37.8%. Li Auto delivered 30,731 vehicles in July, and the new third-quarter outlook suggests that the company expects to deliver a similar number of vehicles in the next two months, despite the introduction of new products.

Total revenue is also expected to decrease by 42.1% to 38.8% in the quarter, ranging from RMB 24.8 billion ($3.5 billion) to RMB 26.2 billion, below the estimated RMB 26.26 billion. For the second quarter through the end of June, the company reported total revenues of RMB 30.2 billion, below the analyst estimate of RMB 31.82 billion.

Adjusted and diluted net earnings per American depositary share (ADS) attributable to ordinary shareholders were RMB 1.37 in the second quarter, lower than an estimated RMB 1.73.

LI stock is down 3% this year but up approximately 18% over the past 12 months.

Also See: De Minimis Ends Today – Here’s Who’s Likely To Win And Lose After US Tariff Shift

For updates and corrections, email newsroom[at]stocktwits[dot]com

Exchange Rate: RMB1= $0.14

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Morgan_Stanley_HQ_logo_5431c7f2ad.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1549425533_jpg_483afd6d69.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_down_resized_901c19c371.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235778544_jpg_2b7ceca102.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)