Advertisement|Remove ads.

Cleveland-Cliffs Stares At Tough Q4 As Weak Steel Prices, Sluggish Demand Weigh On Topline: Retail’s Divided

Cleveland-Cliffs Inc. (CLF) is expected to post financial results after the market closes on Monday, showing a revenue decline during the fourth quarter. Dual headwinds of weak steel prices and sluggish demand are likely to weigh on the company’s topline.

Wall Street estimates show Cleveland-Cliffs could post a loss of $0.61 per share, significantly higher than the $0.05 per share loss during the same period last year.

As for the topline, Cleveland-Cliffs posted preliminary results showing $4.3 billion in Q4, falling over 15% from $5.11 billion a year ago.

Demand for steel in the U.S. weakened in 2024 after a substantial rise in 2023. Factors like sluggish industrial production and construction activity during Q4 are expected to put downward pressure on Cleveland-Cliffs’ revenue.

“Other than the COVID-impacted 2020, 2024 was the worst year for domestic steel demand since 2010. As the largest supplier to the automotive industry in North America, we were especially impacted by muted demand from this sector in the second half of the year,” said Lourenco Goncalves, CEO of Cleveland-Cliffs.

He underscored that the muted demand is the “primary driver” of the company’s weak Q4 but said it is the trough going forward.

He supported the recently announced tariffs on China, Canada, and Mexico, saying President Donald Trump’s manufacturing-friendly agenda would benefit the company.

According to Stocktwits data, for the full year 2024, Cleveland-Cliffs posted preliminary revenue of $19.2 billion, below Wall Street expectations of $19.3 billion.

The Ohio-based steelmaker expects to ship 15.6 million net tons during the year, down from 2023’s 16.4 million net tons shipment.

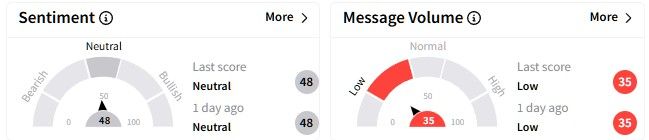

Retail sentiment on Stocktwits around the Cleveland-Cliffs stock was divided, hovering in the ‘neutral’ (48/100) territory.

Cleveland-Cliffs’ share price has been trending downward recently, falling more than 14% in the past six months.

Its one-year performance has been worse, with the stock falling nearly 44%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Also See: Hawaiian Electric Q4 Earnings Miss On Higher Expenses Sends Stock Sliding: Retail’s Divided

/filters:format(webp)https://news.stocktwits-cdn.com/large_Circle_Internet_jpg_add0182c9c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1227710498_jpg_fbb12d04bf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)