Advertisement|Remove ads.

Cloudflare Stock Heads To Over 3-Year Highs On Q4 Earnings Beat, Retail Debates 2025 Outlook

Cloudflare Inc. (NET) surged nearly 10% in pre-market trading on Friday, on track to hit an over three-year high at market open after the cloud-based cybersecurity company’s fourth-quarter earnings beat analysts’ estimates.

However, its 2025 outlook fell slightly short of market expectations, sparking mixed reactions from retail investors.

If pre-market gains hold, Cloudflare’s stock will reach its highest level since Dec. 2021.

For the fourth quarter, Cloudflare reported adjusted earnings per share (EPS) of $0.19, surpassing the consensus estimate of $0.18.

Revenue climbed 27% year-over-year to $459.9 million, exceeding forecasts of $452.04 million.

The company’s large customer base—those spending over $1 million annually—grew 47% year-over-year to 173, with more than half of the 55 new additions coming in the final quarter of 2024.

“We had a very strong end to 2024,” said Cloudflare co-founder and CEO Matthew Prince.

For the first quarter of 2025, Cloudflare projected revenue between $468 million and $469 million, slightly below the $471 million consensus on Koyfin.

The company expects adjusted EPS of $0.16, compared to analyst estimates of $0.17.

For the full year, Cloudflare forecasts revenue between $2.09 billion and $2.094 billion, narrowly missing the $2.099 billion consensus.

Its adjusted EPS guidance of $0.79 to $0.80 for 2025 was also below expectations of $0.83.

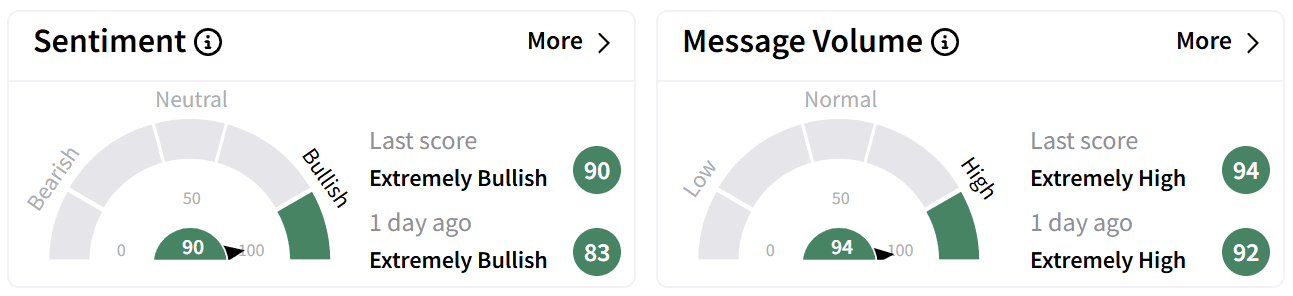

On Stocktwits, retail sentiment around Cloudflare edged higher into the ‘extremely bullish’ zone accompanied by ‘extremely high’ chatter.

Some platform users feel the stock will fall once the market opens, given its 2025 outlook, which is below market expectations.

Cloudflare’s stock has gained over 75% in the past year and is up 23% in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read also: CleanSpark Stock Climbs As Bitcoin Miner Blows Past Q1 Earnings Estimate: Retail Cheers

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2239867148_jpg_8df22810c1.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227347123_jpg_b7a8c29717.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1236199359_jpg_28b0018e3a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2199401088_jpg_656c1eacd4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_wall_street_sign_resized_f75f6c0a63.jpg)