Advertisement|Remove ads.

Strategy Stock Edges Up On Resuming BTC Purchases Despite Wall Street’s Price Cuts: Retail’s Worried

Shares of Strategy Inc. (MSTR), formerly MicroStrategy, edged up by over 2% in morning trade on Monday despite analysts at Barclays trimming their price target for the Bitcoin (BTC) proxy’s stock.

According to TheFly, Barclays analysts trimmed their price target for the Strategy shares to $421 from $515 while maintaining an ‘Overweight’ rating on the stock. Based on current levels, this reduces the implied upside to 26% from 54%.

This comes after Strategy’s fourth-quarter earnings miss.

The Michael Saylor co-founded company posted a wider-than-expected loss of $3.03 per share versus estimated earnings per share (EPS) of $0.50, according to data from FinChat.

The company’s revenue stood at $120.7 million during this period, below the estimated $122.73 million.

This led to Canaccord analyst Joseph Vafi's halving of the equity premium, who trimmed the price target to $409 from $510, according to TheFly.

Meanwhile, Strategy resumed its Bitcoin purchases. The company scooped up 7,633 BTC for $742.4 million at an average price of $97,255 per BTC.

As of Feb. 9, Strategy’s total Bitcoin holdings stood at 478,740 BTC, acquired for $31.1 billion at an average price of $65,033 per BTC.

Based on current Bitcoin prices, Strategy’s BTC holdings were valued at $46.45 billion, which translates to an unrealized gain of 49.4%.

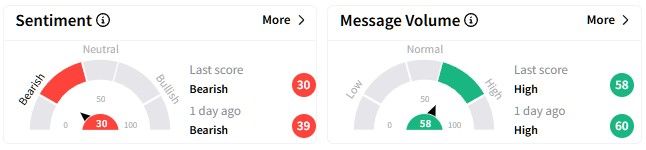

On Stocktwits, retail sentiment around the Strategy stock worsened. It hovered in the ‘bearish’ (30/100) territory, declining from a day ago. Message volume remained in the ‘high’ (58/100) zone.

Users on the platform expressed their lackluster outlook on Strategy stock, with one quipping that it will fall to $50 a piece over time.

Strategy’s stock price surged nearly 154% over the past six months, while its one-year gains stood at 365%.

In comparison, Bitcoin prices have only gained more than 60% during the past six months and more than doubled over the past year, with gains of 103%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2244298120_jpg_ceb8c90666.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_iran_jpg_753ef9f5af.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1813801150_jpg_9e452258fa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2190302521_jpg_796f64970e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194612888_1_jpg_5f7b7f6186.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1384896168_jpg_87fab3f04d.webp)