Advertisement|Remove ads.

Honeywell To Acquire Pump Manufacturer Sundyne In $2.16B All-Cash Deal With Warburg Pincus — Retail’s Positive

Honeywell International Inc (HON) stock drew investor attention on Tuesday after the company said it has agreed to acquire Sundyne from private equity firm Warburg Pincus for $2.16 billion in an all-cash transaction.

The transaction price represents approximately 14.5-times 2024 earnings before interest, tax, depreciation, and amortization (EBITDA) on a tax-adjusted basis.

Sundyne is involved in the design, manufacture, and aftermarket support of highly engineered pumps and gas compressors used in process industries.

Honeywell expects the deal to be immediately accretive to its sales growth and segment margin, as well as to adjusted earnings per share (EPS) in the first full year of ownership. The acquisition is expected to close in the second quarter of 2025.

Honeywell CEO Vimal Kapur said Sundyne's vast installed base of top-of-the-line pumps and compressors will further strengthen Honeywell's brand in the process industry and create significant opportunities to continue expanding its aftermarket services business.

Other benefits anticipated by Honeywell include the expansion of Energy and Sustainability Solutions business segment capabilities and the enhancement of end-to-end solutions in process technologies and critical equipment, alongside automation and control systems enabled by Honeywell Forge.

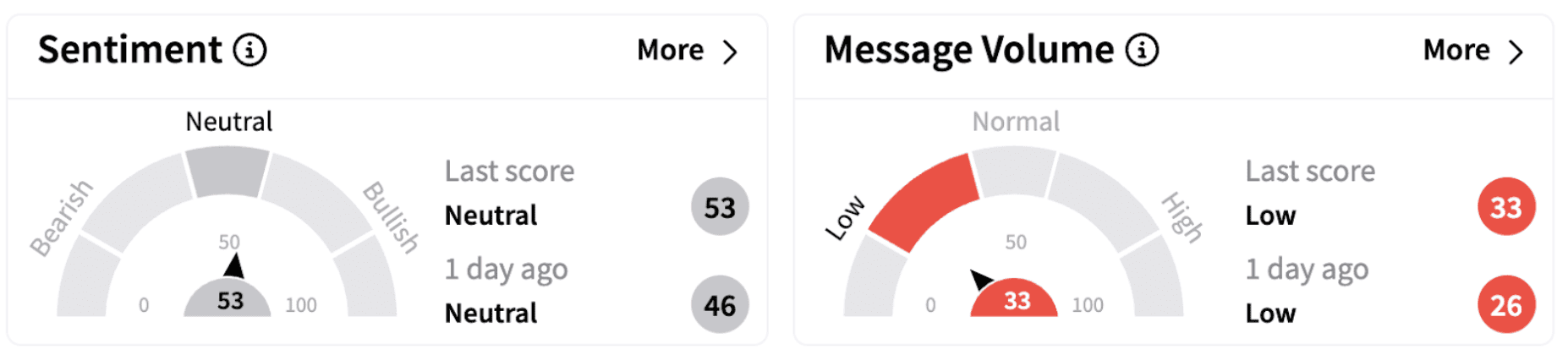

On Stocktwits, retail sentiment surrounding Honeywell International climbed further into the ‘neutral’ territory.

Last month, Honeywell announced its intention to split into three separate listed entities by the second half of 2026.

The company said that the three entities — Honeywell Automation, Honeywell Aerospace, and Advanced Materials — will have distinct strategies and growth drivers. The decision came months after activist investor Elliott Investment Management took a $5 billion stake in the firm.

Honeywell also highlighted that the three independent companies will be appropriately capitalized to take advantage of future growth opportunities.

Meanwhile, Honeywell shares opened in the red on Tuesday morning. The stock has lost over 6% in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_altcoins_5a22b361ff.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)