Advertisement|Remove ads.

CMS’s Initial Proposal To Cover Renal Denervation A Win For Medtronic, Says Analysts

Analysts are optimistic about Medtronic (MDT) after the Centers for Medicare and Medicaid Services (CMS) proposed to cover renal denervation for uncontrolled hypertension.

CMS on Thursday posted its proposed decision memo, stating that it proposes to cover radiofrequency renal denervation and ultrasound renal denervation for uncontrolled hypertension. The agency is now seeking comments on its proposed decision, and a final decision is expected by October 8.

Renal denervation (RDN) is a new technology that uses catheters placed into the renal (kidney) arteries to ablate, or destroy, the renal sympathetic nerves to reduce blood pressure. RDN is intended to complement medications and lifestyle changes in patients with uncontrolled hypertension.

Hypertension can lead to serious problems such as heart attack and stroke, the agency noted.

Medtronic, the medical technology provider, has an RDN system called Symplicity Spyral, which was granted FDA premarket approval in November 2023. The system disrupts the overactive sympathetic signaling between the kidneys and brain to reduce blood pressure.

MDT shares were trading 1% higher at the time of writing.

Several analysts reacted to the news:

- Stifel maintains a ‘Hold’ rating and $87 price target on Medtronic shares. The Centers for Medicare & Medicaid Services' initial proposal for renal denervation reimbursement "seems positive," the firm noted.

- JPMorgan, meanwhile, keeps a ‘Neutral’ rating on Medtronic. JPMorgan told investors in a research note that there is no arguing that a broad national coverage decision for renal denervation is a win for Medtronic. This will enable the company to begin targeting the potentially multi-billion-dollar opportunity once the final rule is released in October, according to the analyst. However, JPMorgan believes it will "take some time to get there" as the company will need to educate primary care physicians and general cardiologists.

- BTIG analyst Ryan Zimmerman keeps a ‘Neutral’ rating on Medtronic. BTIG said that while the news was expected, it is still a win for Medtronic. BTIG believes the decision opens up Medtronic to a "massive" potential patient pool.

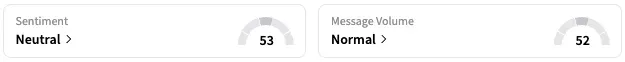

On Stocktwits, retail sentiment around Medtronic stayed within ‘neutral’ territory over the past 24 hours while message volume stayed at ‘normal’ levels.

MDT stock is up by nearly 13% this year and by over 15% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2260447662_jpg_cd246b74f6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2254924116_jpg_d54ffea07e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2228900989_jpg_e94daec744.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_Red_OG_jpg_d64521f99a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)