Advertisement|Remove ads.

Coal Stocks Rise As Trump Signs Executive Orders To Boost Output, Retail’s Elated

Coal stocks jumped on Tuesday after President Donald Trump signed several executive orders to boost coal production and usage for electricity generation.

Hallador Energy (HNGR), Warrior Met Coal (HCC), and Peabody Energy (BTU) rose between 6.3% and 9.2% on Tuesday.

“All those plants that have been closed are going to be opened if they’re modern enough, or they’ll be ripped down and brand new ones will be built,” Trump said on Tuesday at the White House.

Trump also asked federal agencies to find coal resources on federal lands, lift barriers to coal mining, and prioritize coal leasing on U.S. lands.

He also signed a proclamation exempting coal-fired power plants from federal requirements to cut emissions of toxic chemicals such as mercury, arsenic, and benzene for two years.

The President’s policies mark a stark shift from those of his predecessor, Joe Biden, whose administration passed several rules targeting heavily polluting coal plants.

According to Energy Information Administration (EIA) data, coal's share of the U.S.'s utility-scale electricity-generation capacity has fallen to about 16% from more than 42% in the 1990s.

Power demand in the U.S. is expected to rise rapidly over the next few years, driven by artificial intelligence data centers. Trump has touted coal as a reliable source of energy on several occasions.

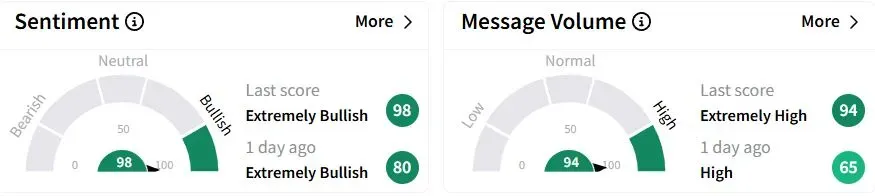

Retail sentiment about Peabody on Stocktwits jumped higher in the ‘extremely bullish’ (98/100) than a day ago, while retail chatter surged to ‘extremely high.’

One retail investor noted that only a few pure-play coal producers exist in the U.S.

Peabody also said on Tuesday that it was reviewing a deal worth up to $3.78 billion to buy Anglo American's steel-making coal business after a fire erupted at an Australian mine.

Peabody shares have fallen 46.71% year-to-date (YTD).

Also See: AeroVironment Stock Gets Double Upgrade On Compelling Valuation, Strikes Chord With Retail Traders

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_uniqure_jpg_33b6552285.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sharp_Link_Gaming_jpg_60ce5684e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_new_york_stock_exchange_jpg_e1f85c0d8c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243050664_jpg_37b52748e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_hims_stock_logo_resized_jpg_5554a2a2c1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Oil_drill_06147e8349.webp)