Advertisement|Remove ads.

Copper Stocks In Focus As Shutdown At Second-Largest Mine Prompts Goldman Sachs To Slash Global Supply Forecast

Copper miner stocks will be in focus on Wednesday after Goldman Sachs lowered the global production forecast of the red metal due to the shutdown of Freeport-McMoRan’s giant Grasberg mine in Indonesia.

U.S. copper futures rose over 1% in early trading, as the investment bank’s analysts projected that the lost output at the second-biggest copper mine will wipe out 525,000 metric tons of supply, according to a Reuters News report. The firm also lowered its global supply for the second half of 2025 by 160,000 tons and its 2026 forecast by 200,000 tons.

The deficit could boost copper prices and aid miners such as Teck Resources, BHP Group and Southern Copper.

The firm also projected a deficit of 55,500 tons in the copper supply chain, based on a prediction of a production surplus of 105,000 tons. However, in 2026, copper supplies are expected to exceed demand.

Freeport on Wednesday revealed that at least two workers died in a mud flow incident at the mine on Sept. 8, and five workers are missing. The company has shut down operations at the project and noted that, for the third quarter of 2025, its consolidated sales are expected to be approximately 4% lower for copper and approximately 6% lower for gold than it estimated in July.

Goldman said Freeport believes that fourth-quarter output from the mine will be very low, as the unaffected areas of the mine could restart in the middle of the quarter. The firm reportedly stated that the unaffected portion accounts for approximately 30%-40% of Grasberg's annual production capacity. The rest of the mine is expected to restart sometime in 2026.

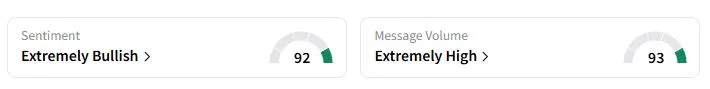

Retail sentiment on Stocktwits about Freeport was still in the ‘extremely bullish’ territory at the time of writing. The stock fell nearly 17% on Wednesday, the worst day since March 2020.

“I can see them ramp up production in other geographic areas to help make up some of the production and take advantage of the higher copper prices,” one user wrote.

Freeport-McMoRan stock has declined 1.3% year-to-date. Separately, Scotiabank analysts also downgraded the stock to ‘Neutral’ from ‘Buy’ due to Grasberg woes.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Circle_Internet_jpg_add0182c9c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1227710498_jpg_fbb12d04bf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)