Advertisement|Remove ads.

CorMedix Stock Rises After-Hours: CEO Locks In Chairman Seat, Bigger Paycheck And Rich Severance

- The stock rose after a sharp selloff earlier in the session tied to cautious 2026 guidance.

- Analysts flagged a steeper-than-expected slowdown in DefenCath revenue.

- A new CEO employment agreement appeared to help steady investor sentiment following the drop.

Shares of CorMedix Therapeutics rose in after-hours trading on Thursday after the company disclosed an expanded role and revised employment terms for CEO Joseph Todisco, following a sharp selloff earlier in the session tied to cautious guidance.

The stock climbed nearly 1% in after-hours trading on Thursday after crashing 33% in the regular session to log its worst session in over three years.

CEO Elevated To Chairman With Pay Boost

CorMedix said it entered into an amended and restated employment agreement with Todisco on Monday. Under the agreement, Todisco will continue as CEO and will also serve as chairman of the board, effective Thursday.

Todisco’s annual base salary increases to $750,000 from $665,000, effective Jan. 1. His target annual bonus opportunity rises to 75% of base salary from 65%, beginning with fiscal 2026, with payouts based on company and individual objectives set by the board or its compensation committee. He remains eligible for equity awards under the company’s omnibus stock incentive plan as well.

Rich Exit Terms Kick In Under New CEO Deal

If terminated without cause or for good reason, and subject to a customary release, Todisco would receive 18 months of base salary continuation, a prorated annual bonus based on actual performance, subsidized Consolidated Omnibus Budget Reconciliation Act (COBRA) premiums for up to 18 months, acceleration of certain near-term unvested equity awards, and any unpaid prior-year bonus.

If termination occurs within 24 months of a corporate transaction, severance increases to 200% of base salary plus target bonus paid over 24 months, COBRA subsidies extend to 24 months, and all unvested equity awards fully accelerate.

DefenCath Reality Check

On Thursday, CorMedix issued a cautious 2026 outlook, warning revenue could come in below 2025 levels. Following the outlook, Truist Securities lowered its price target to $16 from $20 while maintaining a ‘Buy’ rating, noting that 2026 revenue guidance was roughly 40% below Street expectations and that 2027 DefenCath revenue guidance was about half of its initial estimate.

Truist said this implied a greater tail-off in DefenCath revenue than previously factored and added it expects more detail at the company’s Feb. 10 investor day.

How Did Stocktwits Users React?

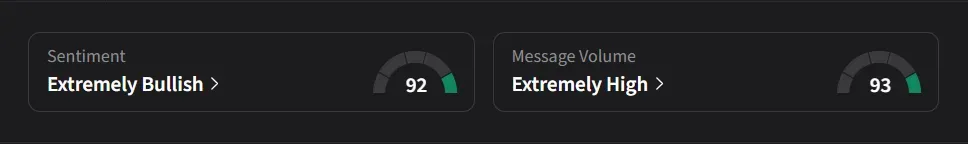

On Stocktwits, retail sentiment for CorMedix was ‘extremely bullish’ amid ‘extremely high’ message volume.

One user said they bought 1,000 shares at $7.42, viewed the stock as oversold despite positive cash flow, and planned to sell above $8.

Another user noted that price targets remain above $15 and that the stock is currently trading at a 50% discount.

CorMedix’s stock has declined 31% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227347123_jpg_b7a8c29717.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1236199359_jpg_28b0018e3a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2199401088_jpg_656c1eacd4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_wall_street_sign_resized_f75f6c0a63.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_fsd_jpg_e90331e6a6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)