Advertisement|Remove ads.

CoreWeave Stock Has Been Unable To Reclaim Its 50-DMA Since November – What Are The Factors At Play?

- Last month, the company said it expects large-scale deployments to pressure near-term margins and reduced its 2025 capex outlook to $12–$14 billion.

- Earlier this month, CoreWeave announced plans for a $2 billion convertible notes offering.

- Mizuho lowered its price target on the stock to $92 from $120 but kept a ‘Neutral’ rating.

CoreWeave Inc. (CRWV) stock has been drawing significant investor interest lately after a crucial support level appears to have turned into a fresh resistance on the daily chart.

CRWV stock has been under pressure lately, falling below its 50-day moving average (50-DMA) in November and has not been able to climb back since. Notably, it had critical support near the $90 mark in August and September, but the level was breached in November. Last week’s rebound failed to take the stock beyond this mark on the upside.

What Are The Latest Developments?

In November, CoreWeave lowered its fourth-quarter guidance despite reporting better-than-expected third-quarter results, with revenue of $1.37 billion and an adjusted loss per share that narrowed sharply to $0.22. The company said it expects large-scale deployments to pressure near-term margins and reduced its 2025 capex outlook to $12 billion to $14 billion, while also cutting full-year revenue and operating income guidance.

The company also announced plans for a $2 billion convertible notes offering, with proceeds earmarked for capped call transactions and general corporate purposes.

Earlier this month, CoreWeave announced a new partnership with Runway to support the AI firm’s video-generation models, using Nvidia’s GB300 NVL72 systems and CoreWeave AI Object Storage.

Mizuho Lowers Price Target

On Tuesday, Mizuho lowered CoreWeave’s price target to $92 from $120 but kept a ‘Neutral’ rating, according to TheFly.

The firm revised its price targets across the software group as part of its 2026 outlook. It highlighted artificial intelligence, data modernization, DevOps, next-generation security, and electronic design automation as the key growth drivers for software companies.

Mizuho added that CoreWeave’s low-teens median revenue growth estimate for 2026 appears achievable and potentially conservative, offering an attractive risk-reward setup heading into next year.

How Did Stocktwits Users React?

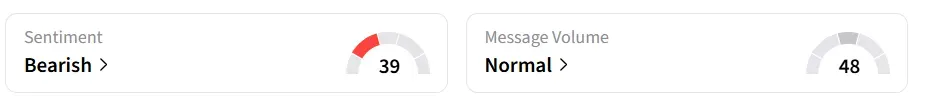

Retail sentiment for CRWV on Stocktwits has remained in the ‘bearish’ territory over the past 24 hours.

One user sees further correction but believes it’s a good time for buyers.

Another user believes that CRWV needs bigger contracts with the likes of META.

Since its March debut, CRWV stock has gained more than 80%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_HPE_office_with_logo_resized_c15b2ba0d3.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_market_fall_generic_jpg_f7dffafa95.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2219201937_jpg_67aaff68c1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2213366819_jpg_3e8b649e98.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_price_rising_OG_jpg_5f141f956f.webp)