Advertisement|Remove ads.

Gold, Silver, And The Jackson Hole Summit - Here's What Economist Robin Brooks Said About The Debasement Trade

- The underlying driver for debasement trade is the fear that inflation will steadily erode long-term savings, Brooks said.

- Gold not leading the metals rally weakens the argument that central banks are behind the move.

- The surge in metal prices is happening while the USD remains broadly stable against other major currencies, indicating a deeper issue with fiat currencies.

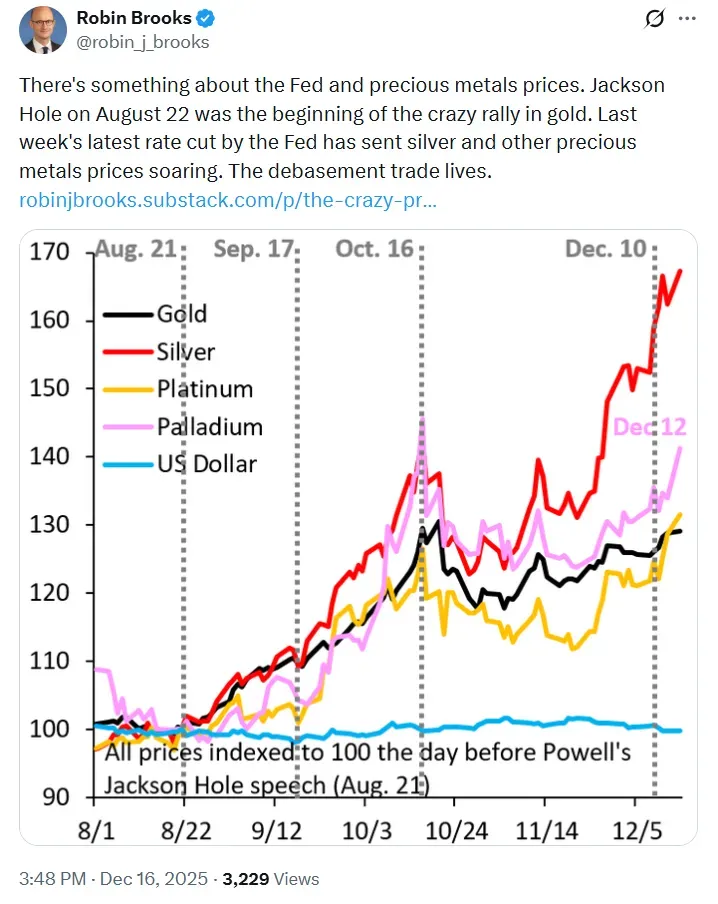

The Federal Reserve’s dovish commentary at the Jackson Hole meeting in August marked a critical point for precious metals this year.

Since then, spot gold has surged nearly 28%, and silver has rallied by around 66%.

Economist Robin Brooks, a Senior Fellow at The Brookings Institution and a former chief FX strategist and managing director at Goldman Sachs, highlighted that the debasement trade continues to thrive.

“Last week's latest rate cut by the Fed has sent silver and other precious metals prices soaring. The debasement trade lives,” he wrote in a post on X.

Search For Safe Havens

The move fits squarely into what can be called the “debasement trade,” where investors move capital out of fiat currencies and debt assets into hard assets such as gold and silver to guard against currency devaluation driven by policy changes.

The underlying driver is the fear that inflation will steadily erode long-term savings. This has led investors to scramble for hedges, which is the primary reason for the increase in precious metals prices.

Momentum Spreading Beyond Gold

What makes the current rally unusual is that gold is no longer the sole driver. Silver’s explosive gains have sparked follow-through buying in platinum and palladium, suggesting momentum trading. Gold not leading the rally also weakens the argument that central banks, particularly in emerging markets, are behind the move.

Spot silver has been on a record-breaking run this month, gaining nearly 14%. It also hit an all-time high of $64.66 per ounce on Friday.

Is The Dollar An Issue?

Importantly, this surge is unfolding while the U.S. dollar remains broadly stable against other major currencies. That signals the problem isn’t dollar weakness, but a more profound unease with fiat money itself, Brooks added. Investors appear to be questioning the long-term purchasing power of paper currencies in general, not just the greenback.

That said, the U.S. Dollar Index (DXY) has fallen from its November high of 100.395 to 98.18, trading below its 200-day moving average.

Earlier pauses in precious metals prices coincided with major global meetings that forced markets to reassess valuations. With no such meetings in the near future, Brooks believes the momentum of precious metals will remain largely unchecked.

ETF Watch

The iShares Silver Trust (SLV) was down 2.1% in premarket trading while the SPDR Gold Shares ETF (GLD) declined 0.6%. Meanwhile, the DXY was little changed at 98.22.

Year-to-date, SLV has gained around 117%, significantly more than GLD’s 62%.

Also See: Why Wharton's Jeremy Siegel Believes Powell's Conceptual Shift On Inflation ‘Matters Enormously'

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1005541622_jpg_8079d8d434.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137832_jpg_1de3e68131.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bmnr_OG_jpg_83d4f3cc27.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_iran_jpg_753ef9f5af.webp)