Advertisement|Remove ads.

CoreWeave Stock Draws Upgrades On Soaring AI Demand: Retail Chatter Sees 582% Spike In 24 Hours

CoreWeave Inc. (CRWV) has drawn fresh attention from Wall Street, with analysts projecting notable growth opportunities driven by long-term industry trends and strategic partnerships.

Wells Fargo upgraded its rating on CoreWeave to "Overweight" from "Equal Weight," raising its price target to $170 from $105, citing long-term benefits from ongoing supply shortages and elevated infrastructure build-outs expected to continue into 2026, according to theFly.

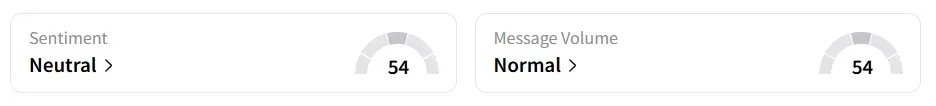

CoreWeave stock traded over 2% higher in Tuesday’s premarket and was among the top five trending equity tickers on the Stocktwits platform. Retail sentiment around the stock shifted to ‘neutral’ from ‘bullish’ territory amid ‘normal’ message volume levels.

The stock saw a 582% surge in user message count in 24 hours.

According to Wells Fargo, ongoing supply constraints in the hyperscaler sector will likely persist through early 2026, allowing CoreWeave to step in and fulfill unmet demand. Wells Fargo notes that this macro backdrop positions the company to capture business from larger players facing hardware bottlenecks.

Adding to CoreWeave’s momentum is a multi-year agreement with Nvidia Corp. (NVDA), the firm said. The tech giant has committed to purchasing any unused CoreWeave capacity through 2032, a move Wells Fargo said effectively gives CoreWeave a financial “blank check” to continue expanding. The deal, signed on September 9, stems from a new order form added to the companies’ existing Master Services Agreement (MSA) signed in April 2023. The agreement's initial value is $6.3 billion.

The firm also cited growing demand signals that it describes as “too strong to ignore.” Melius Research has also upgraded CoreWeave, moving its rating from "Hold" to "Buy" while setting a price target of $165.

CoreWeave stock has gained over 233% so far since its listing in March.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Circle_Internet_jpg_add0182c9c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1227710498_jpg_fbb12d04bf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)