Advertisement|Remove ads.

CorMedix Stock Rises After Preliminary Q1 Results Exceeds Expectations: Retail’s Elated

Shares of biopharmaceutical company CorMedix Inc. (CRMD) traded 15% higher on Tuesday noon after the company reported preliminary first-quarter earnings that beat estimates.

The company reported unaudited net revenue of $39 million for the quarter, which was above an analyst estimate of $32.2 million, according to FinChat data.

CorMedix expects quarterly adjusted earnings before interest, taxes, depreciation, and amortisation (EBITDA) to exceed $22.5 million once final numbers are reported, exceeding expectations of $14.78 million.

The company also increased its first half 2025 (H1) net sales guidance to a revised range of $62 million to $70 million in light of the larger-than-expected orders received during the final week of March. CorMedix had previously guided net sales in the range of $50 million to $60 million for the period.

The firm added that it expects net sales from existing customers in the second quarter to be lower than in the first quarter due to the timing of shipments to those customers.

However, unit shipments in the year's second half are expected to exceed shipments in the first half as implementation expands to new patients.

The company said cash and short-term investments, excluding restricted cash, amounted to approximately $77.5 million at the end of March.

CorMedix expects patient enrollment for its phase 3 study of its lead product DefenCath in patients receiving Total Parenteral Nutrition to begin in late April.

DefenCath was approved by the U.S. FDA in November 2023 and launched by the company in inpatient and outpatient settings last year.

It aims to reduce the incidence of catheter-related bloodstream infections in adult patients receiving chronic hemodialysis with central venous catheters.

If approved for patients receiving Total Parenteral Nutrition, the company believes DefenCath can achieve peak annual sales in this patient population of $150 million to $200 million, with a total addressable market opportunity of $500 million to $750 million.

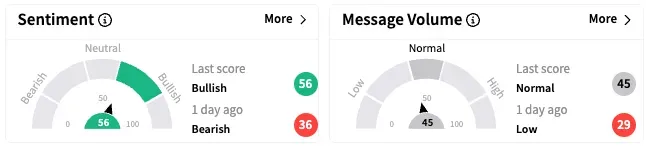

On Stocktwits, retail sentiment around CorMedix rose from ‘bearish’ to ‘bullish’ while message volume jumped from ‘low’ to ‘normal’ over the past 24 hours.

RBC Capital said it remains bullish on CorMedix and added that the company’s pre-report offers some reassurance for the ongoing DefenCath launch, particularly during market/macro uncertainty and volatility.

RBC maintains an ‘Outperform’ rating on the shares with a price target of $12.

CRMD shares are down by 15% this year and up by about 47% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Webull_stock_resized_jpg_48b42f4c8f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Morgan_Stanley_resized_Mar_19_jpg_784f532fd2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2192180432_jpg_5a4c947a6a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243967992_jpg_33943df3b8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2197860201_jpg_c4f2083335.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_US_economy_representative_image_jpg_88c3aa4736.webp)