Advertisement|Remove ads.

Corning Earnings Top Estimates, Retail Buys Dip As Stock Falls 10%

Specialty glass-maker Corning reported revenue of $3.60 billion versus an estimate of $3.55 billion and earnings per share (EPS) of $0.47 versus an estimate of $0.46. Net income fell nearly 63% YoY to $104 million during the quarter, driven by a rise in operating expenses and a decline in the net translated earnings contract gain. Net sales remained flat at $3.25 billion versus $3.24 billion in the same period a year ago.

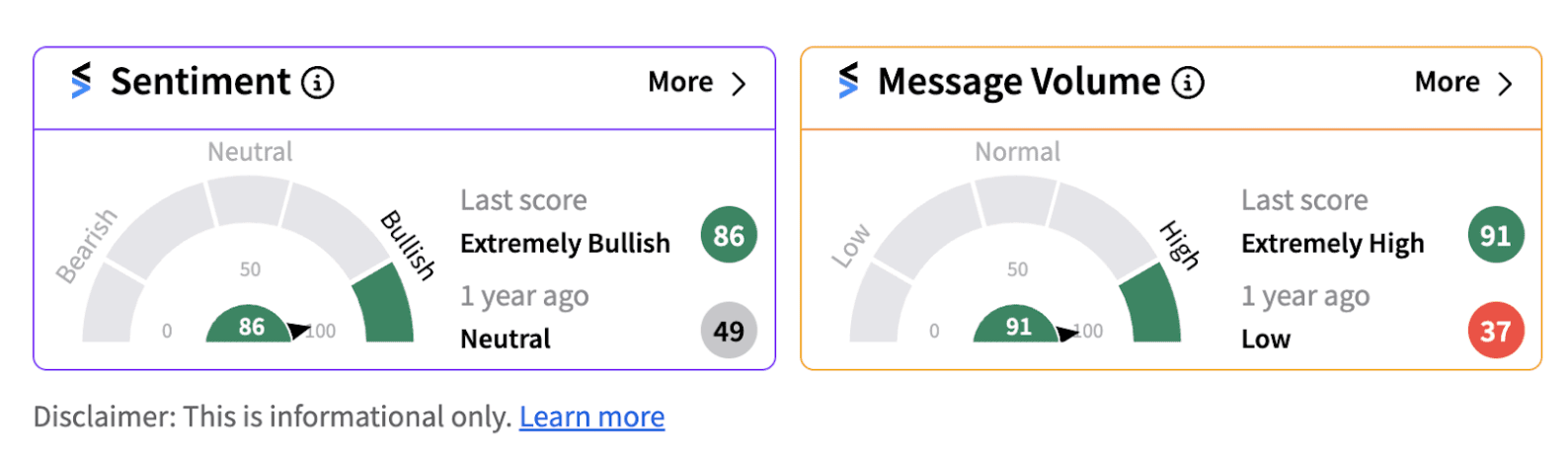

For the third quarter, the management said it expects core sales to grow to approximately $3.70 billion, missing the Street estimate of $3.75 billion and causing shares to drop 10%. Still, retail investors are overlooking those concerns with the Stocktwits sentiment meter trending in extremely bullish territory (86/100) supported by extremely high message volumes.

Corning management believes that the expected sequential sales increase is driven primarily by the continued adoption of new optical connectivity products for generative artificial intelligence (AI) in Optical Communications. It expects that will more than offset the expected slowdown in the North American Class 8 truck market.

Gross margin during the quarter stood at 29.20% while core gross margin improved sequentially and year-over-year by 110 and 170 basis points, respectively, to 37.90%. Management believes this quarter’s results and outlook reinforce confidence in its ‘Springboard’ plan to add over $3 billion in annualized sales with strong incremental profit and cash flow over the next three years.

From a segmental point of view, Specialty Materials recorded a 91% YoY jump in its net income at $63 million. Display Technologies posted a 24% rise in net income while the Life Sciences segment witnessed a 55% jump in earnings. Environmental Technologies was the main laggard, reporting a 9% earnings decline.

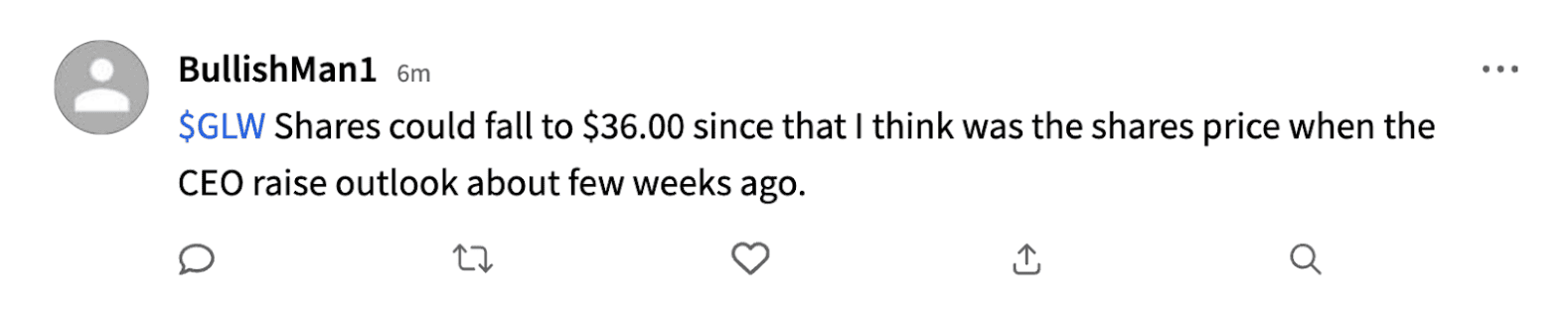

Notably, several weeks ago, the firm had raised its second quarter revenue and earnings guidance, leading to a 12% jump in the stock. One Stocktwits user named “BullishMan1” believes today’s miss of analyst expectations may cause the stock to revisit the levels it was at before the management’s update.

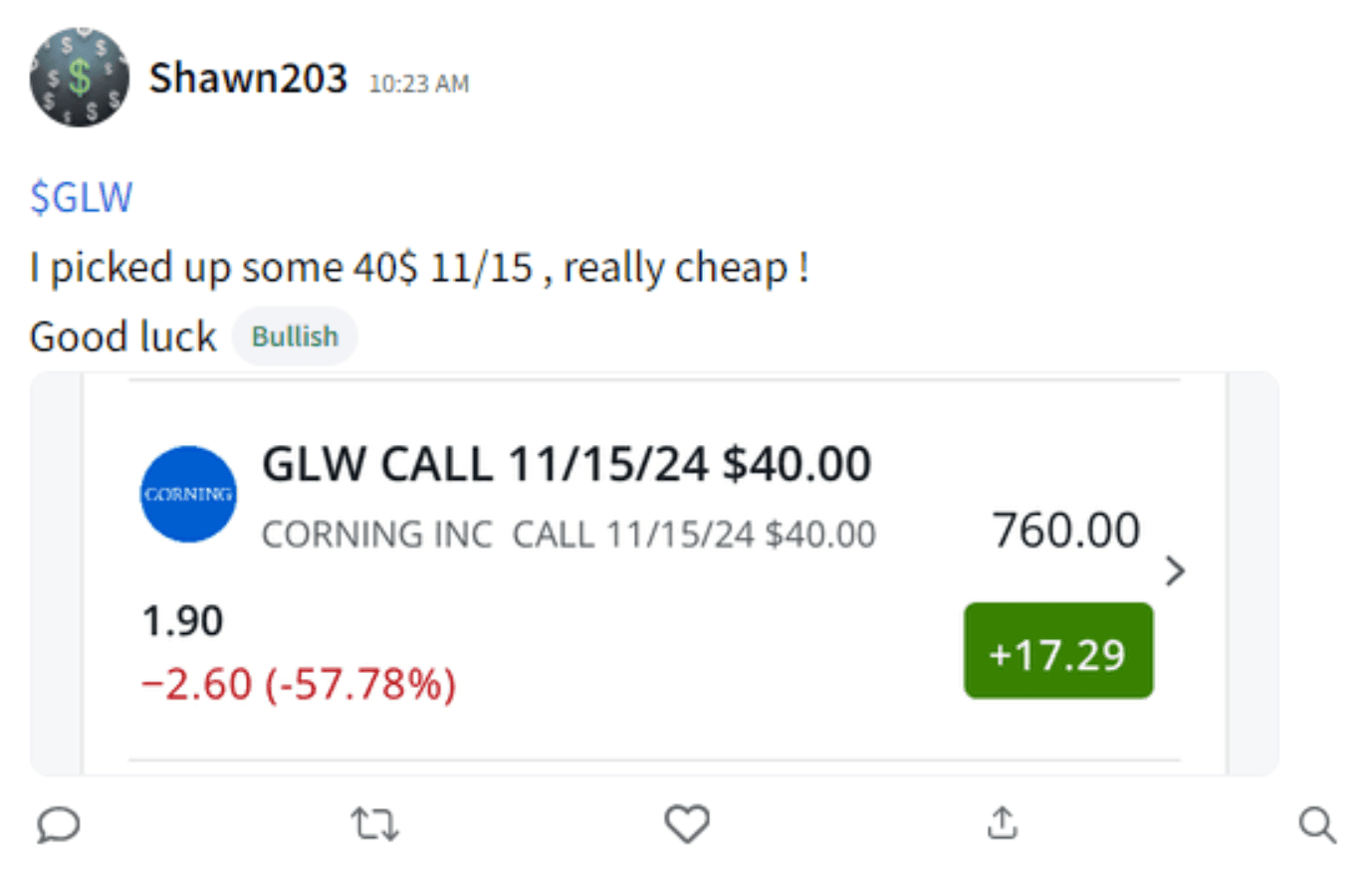

Still, the overall bullish sentiment on Stocktwits suggests retail is buying the dip. Stocktwits user Shawn203 picked up several call options betting on the stock topping $40 again by mid-November.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1549425533_jpg_483afd6d69.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_down_resized_901c19c371.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235778544_jpg_2b7ceca102.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_hawaiian_electric_resized_4b766fd741.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)