Advertisement|Remove ads.

Corvus Pharma Stock Dips Over 6% After-Hours Following Best Day Ever — What Went Wrong?

- The company announced a $150 million public stock offering, including common shares and pre-funded warrants.

- Proceeds are expected to support ongoing clinical programs, including late-stage lymphoma research and multiple mid-stage skin and respiratory trials.

- Several Wall Street firms raised their price targets following the release of positive Soquelitinib data.

Corvus Pharmaceuticals Inc. shares slid in extended trading on Tuesday after the company announced a $150 million public stock offering, following their best session on record that was driven by positive results from an atopic dermatitis trial and multiple analyst price target upgrades.

The stock surged 166% to close at a record high of $21.41 on Tuesday, before dipping over 6% in after-hours trading.

Stock Offering Weighs On Shares

Corvus said it has launched an underwritten public offering of $150 million, consisting of common shares and pre-funded warrants offered to certain investors. The company said underwriters will also have a 30-day option to purchase up to an additional $22.5 million in shares at the offering price, before fees and commissions.

Corvus said the funds will be used to support general corporate operations, including capital expenses and continued research and development. That covers research into its Phase 3 program for T cell lymphoma, as well as Phase 2 studies for atopic dermatitis, hidradenitis suppurativa, and asthma, and also sales, marketing, and administrative expenses.

Rally Driven By Positive Eczema Data

Earlier in the day, Corvus reported positive results from cohort 4 of its placebo-controlled study of Soquelitinib in atopic dermatitis.

Corvus reported that all patients enrolled in the cohort completed 56 days of treatment and had baseline characteristics generally consistent with those of previous cohorts. However, their mean Eczema Area and Severity Index score was higher than that of cohorts 1 and 2.

The company said 75% of patients saw their eczema improve by at least 75%, while 25% experienced a 90% or greater improvement after treatment with Soquelitinib. Corvus also reported that about a third of patients had an Investigator Global Assessment score of 0 or 1, indicating the disease was rated as clear or almost clear.

“The results from cohort 4 increase our confidence that Soquelitinib could become a leading oral therapy for the treatment of atopic dermatitis,” CEO Richard Miller said in a statement.

Analysts Raise Price Targets

Following the data release, H.C. Wainwright raised the firm’s price target to $27 from $11 and maintained a 'Buy' rating, citing “game-changing” topline results from cohort 4 of the Phase 1 study of Soquelitinib in refractory atopic dermatitis. Based on the findings, the firm said it increased its projected market penetration assumption to 30% from 10%.

Barclays also raised its price target to $28 from $16 and maintained an 'Overweight' rating after the company reported positive Phase 1 data.

Mizuho raised its price target to $20 from $13 and reiterated an 'Outperform' rating. The firm said the new data were “outstanding” and support its view of Soquelitinib as a potential best-in-disease agent in atopic dermatitis. Mizuho added that Corvus remains a top pick for January.

How Did Stocktwits Users React?

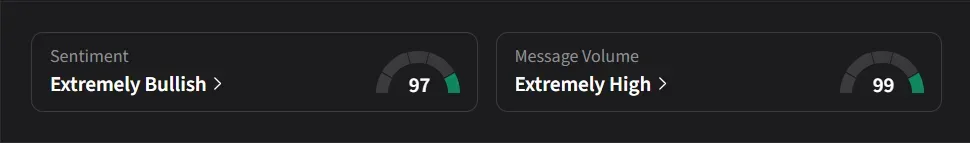

On Stocktwits, retail sentiment for Corvus ended on an ‘extremely bullish’ (97/100) note, with the score hitting a lifetime high; 24-hour message volume spiked by more than 10,000%, and watchers jumped by nearly 9%.

One user said, “Truth be told, I would have preferred a partnership announcement today, not a public offering. But they did what they had to do. You don't leave money on the table.”

Another bearish user said, “Sick market, phase 1 hype, expected dilution, and it largely sticks the landing. Makes no sense.”

Corvus’ stock has soared 327% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_altcoins_1ebecab605.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_ATM_5257ead046.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_qatarenergy_jpg_907aa26daf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262161352_jpg_832967dbca.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243817419_jpg_fd782b2997.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2191224409_jpg_fd3e69e2d7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)